Jul 7, 2016 | News

ALBERTA STANDARD AUTOMOBILE FORM – TRANSPORTATION NETWORK SPF No 9

The Alberta Auto Essentials Course has just been added to all ILS General and Adjuster CE Course Subscribers. This brand new course is accredited for 4 CE credits in Alberta and takes you step by step through the major policy forms and applications for automobile insurance in the province of Alberta. The Alberta Auto essentials course includes the new form – SPF 9 – Transportation Network, which became effective July 1, 2016.

What exactly is the new SPF 9 form – Transportation Network all about?

Here are some SPF 9 policy definitions taken from the Alberta Auto Essentials Course

DEFINITIONS

(a) “transportation network” means any online enabled application, digital platform, software, website, or any other system offered, used or operated by a transportation network company and that is used by persons to prearrange the transportation of passenger(s) for compensation in a transportation network automobile.

(b) “transportation network automobile” means an automobile used to provide prearranged transportation of passenger(s) for compensation through the use of a transportation network.

(c) “transportation network company” means a corporation, partnership, sole proprietorship, association or other entity or individual that connects passenger(s) with transportation network drivers for prearranged transportation exclusively through the offering, use or operation of a transportation network.

(d) “transportation network driver” means a person authorized by a transportation network company to use a transportation network automobile to provide prearranged transportation of passenger(s) for compensation through the use of a transportation network.

(e) “transportation network automobile owner” means the owner of a transportation network automobile, or if the transportation network automobile is leased, the lessee and lessor of the transportation network automobile.

More Info on Alberta Auto Essentials Course

Jul 6, 2016 | News

ILScorp launches new Alberta Auto Essentials course to include the Alberta Standard Automobile Insurance Policy Form – TRANSPORTATION NETWORK SPF No 9.

Effective July 1, 2016.

The Alberta Auto Essentials Course has just been added to all ILS General and Adjuster CE Course Subscribers. This brand new course is accredited for 4 CE credits in Alberta and takes you step by step through the major policy forms and applications for automobile insurance in the province of Alberta.

With the new SPF 9 Policy form – Transportation network company means a corporation, partnership, sole proprietorship, association or other entity or individual that connects passenger(s) with transportation network drivers for prearranged transportation exclusively through the offering, use or operation of a transportation network.

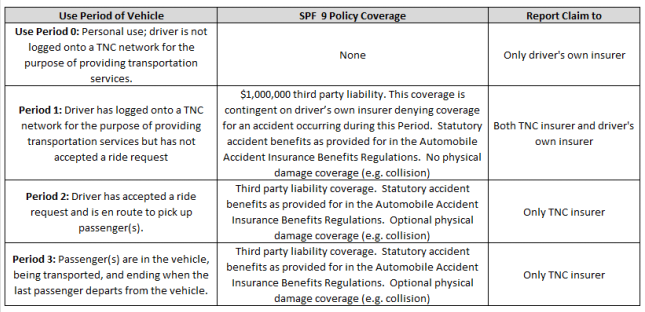

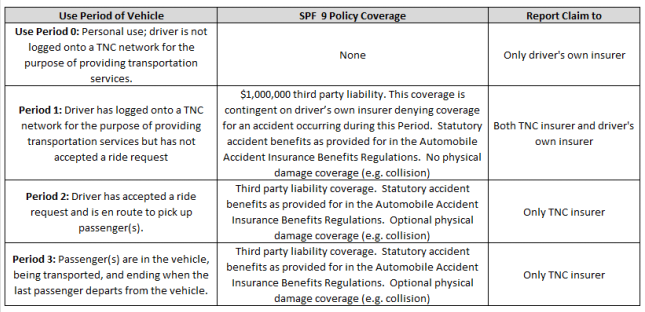

SPF 9 is a purpose built form for very specialized coverage. Under the terms of the coverage there are 4 “USE PERIOD OF VEHICLE”.

These periods will determine the insurance policy in effect and claims reporting.

SPF 9 – Transportation Network Company Use Period Chart

This is just a brief introduction to the newest Alberta Standard Automobile Form – SPF 9 – Transportation Network, to learn more take the new Alberta Auto Essentials Course now as part of your ILScorp CE Subscription.

Topics covered in the course include:

- SPF 1 – Standard Automobile Policy

- SPF 4 – Garage Policy

- SPF 6 – Non Owned Vehicle

- SPF 9 – the newest form – Transportation Network

Applicable endorsements and application forms are also covered.

Jul 2, 2016 | News

We advise our brokerages that ILScorp is on the ICS Courier route. ICS is Canada’s Business-to-Business Courier, more information can be found here.

All business payments can be forwarded via ICS or can be made by calling ILScorp and paying via credit card at 1.800.404.2211.

Jun 29, 2016 | News

The June 30 CE Credit Deadline is here!

Don’t panic just yet.

ILScorp has REAL PEOPLE standing by to help you meet your requirements.

Chat with us live on our website:ilscorp.com.

Email us: info@ilscorp.com or call us 1-800-404-2211 and get your CE done today!

Get online and get to work!

CE with ILScorp is Fast, Easy and DONE!

Accredited Continuing Education courses for General Insurance

Access over 180 accredited general insurance training courses in both text and streaming video formats, including personal lines, commercial lines, auto, farm, professional management and personal skills courses.

More Info

Accredited Continuing Education courses for Adjusters

Access numerous adjuster specific accredited courses plus general insurance training courses in both text and streaming video formats including a 3-part Adjusters Privacy Compliance Program.

More Info

Accredited Continuing Education courses Life/A&S

Access over 70 accredited Life/A&S insurance training courses in both text and streaming video formats including errors & omissions insurance, money management planning process and insurance and estate planning.

More Info

Advantages of the ILS continuing education course subscriptions:

- Once you purchase your subscription, you can begin taking your courses immediately! If you are a new subscriber, you will receive an automated username and password by email.

- Access more than 180 accredited general insurance training courses in both text and streaming video formats, including personal lines, commercial lines, auto, farm, professional management and personal skills courses.

- Access more than 75 accredited life/A&S insurance training courses in both text and streaming video formats including errors & omissions insurance, money management planning process and insurance and estate planning.

- Have a digital record of your completed course work, which we keep on file for up to seven years.

- Save time by completing your general insurance continuing education requirements entirely online, no paperwork or commute.

- Courses can be accessed any time and you can log in and log out as many times as you wish during the course period.

- Quizzes and Final exams are offered in most of our courses to help you retain the information.

- Should you require any assistance at any time during your course work, we are here to support you 5 days a week, 0800 – 1700 PST.

Join the more than 22,000 Canadian insurance professionals who develop their skills with ILScorp each year!

Jun 21, 2016 | News

This course is included as part of your ILS General CE and/or Adjuster CE Course Subscription and qualifies for 1 continuing education hour of credit.

Alberta Insurance Adjusters and Alberta Insurance Brokers: AIC# 42949

Wawanesa Habitation Wording Update

The Wawanesa Habitation policy wordings are reviewed on a regular basis to ensure that the wordings are clear and consistent with Wawanesa’s underwriting and claims intent. In many instances, the Insurance Bureau of Canada (IBC) Advisory wordings were adopted. The wordings consist of two sections: Section I – Property Coverage and Section II – Liability Coverage. This wording booklet is also applicable to the habitational portion of Farm risks and is contained verbatim in ‘Your Farm Insurance Policy’

The policy wordings are reviewed on a regular basis to ensure that the wordings are clear and consistent with our underwriting and claims intent. In many instances, the Insurance Bureau of Canada (IBC) Advisory wordings were adopted.

The purpose of this learning opportunity is to highlight the changes that were made to the wordings effective January 1, 2015. It is not meant to cover all aspects of Habitation coverages.

Topics include:

- Definitions, Property Coverages

- Additional Coverages

- Additional Coverages – Condos

- Additional Coverages – Tenants

- Forms

- Peril Highlights

- Section I – Optional Coverages

- Section I – Loss or Damage Not Insured

- Section I – Conditions

- Section II – Liability Coverage

Included as part of the ILScorp General Insurance CE Subscription

Included as part of the ILScorp Adjuster CE Subscription

Become an ILScorp group member to save even more

Credit Hours: 1

Credit Type: General/Adjuster – Technical

Accrediting Provinces: BC, AB, SK, MB, ON

Credit #: AIC# 42949; MB# 26233

It is recommended that you download ‘Your Personal Insurance Wording 2015’ from the resource tab located in this online course. The wording booklet will be a valuable tool as you continue with the online course.

Course Definition Sampling:

Here is an example of some definitions that are new to the Wawanesa wording booklet:

“Aircraft” is newly defined and includes, airplanes, helicopters, hot air balloons, drones, unmanned aerial vehicles (UAV) and hovercrafts. It is important to include UAVs and drones in the definition to reduce ambiguity. In the past the common language definition of aircraft was relied upon. Over time technology has changed and by providing a proper definition it adds clarity to the intent of what is meant to be covered.

“Pollutant” means any solid, liquid, gaseous or thermal irritant or containment, including but not limited to fuel oil, vapour, soot, chemicals, pesticides, herbicides, waste and smoke from agricultural smudging or industrial operations. The addition of Pollutant to the Homeowner wording ensures consistency with the the Farm wordings, which previously contained this definition.

“Spouse” used to be embedded in the definition of Insured and Residence Employee. Spouse is now defined to closely follow the Ontario Family Law Act, which has been vetted by the Supreme Court of Canada.

“Surface Waters” means water or natural precipitation temporarily diffused over the surface of the ground, not caused by “flood” or escape of water from a “domestic water container” or “watermain”. The concerns regarding surface waters has increased due to catastrophes over the last few years and needed to be addressed.

“Watermain” means a pipe forming part of a water distribution system, which conveys consumable water but not waste water. This is an important definition when discussing the water exclusion that will be addressed later.

The following definitions have been revised from the previous version of the booklet.

“Business” has been clarified to read “the continuous or regular pursuit undertaken for financial compensation, including any trade, profession or occupation”.

“Computer Software” and “Software” have been combined under one definition; and means computer programs and/or instructions stored on electronic media, excluding video games of any kind

“Dwelling” has been expanded to include: ‘…described on the Declarations wholly or partially occupied by you as a private residence’

“Vacant” and “Vacancy” has been a contentious issue within the industry and there have been many prominent court cases on the issue. To clarify the issue further, the wording has been revised to:

Referring to the circumstance where, regardless of the presence of furnishings:

a.All occupants have moved out with no intention of returning to reside continuously in the dwelling and no new occupant has taken up residence OR

b.Where a newly constructed or acquired dwelling, no occupant has yet taken up residence