May 31, 2016 | News

Don’t panic just yet.

Your CE deadline is here, but so is ILScorp!

We have REAL PEOPLE standing by to help you meet your requirements.

Chat with us live on our website: ilscorp.com.

Email us: info@ilscorp.com or call us 1-800-404-2211 and get your CE done today!

Get online and get to work! CE with ILScorp is Fast, Easy and DONE!

Online CE Course Subscriptions

Accredited Continuing Education courses for General Insurance

Access over 180 accredited general insurance training courses in both text and streaming video formats, including personal lines, commercial lines, auto, farm, professional management and personal skills courses.

More Info

Accredited Continuing Education courses for Adjusters

Access numerous adjuster specific accredited courses plus general insurance training courses in both text and streaming video formats including a 3-part Adjusters Privacy Compliance Program.

More Info

Accredited Continuing Education courses Life/A&S

Access over 70 accredited Life/A&S insurance training courses in both text and streaming video formats including errors & omissions insurance, money management planning process and insurance and estate planning.

More Info

FPSC Accredited Continuing Education courses for Certified Financial Planner Professionals and FPSC Level 1 Certificants

Access to over 60 FPSC CE accredited online training courses. Accreditation is Canada wide, categories include: Financial Planning and Practice Management

More Info

May 26, 2016 | News

All licensees are required to meet the continuing education (CE) requirements outlined below for each license year.

A license year runs from 01JUN to 31MAY annually.

If a licensee has been licensed for any part of a license year, the individual must meet the full number of continuing education requirements, whether the license was active or inactive.

General insurance – June 1 to May 31 annually – 4, 6 or 8 CE credits, depending on experience (see below for more information)

Adjusters – June 1 to May 31 annually – 4, 6 or 8 CE credits, depending on experience (see below for more information)

Life and Accident and Sickness – from June 1 to May 31 annually – 5, 10 or 15 CE credits, depending on experience (see below for more information)

View Online CE Subscriptions

Depending on what license the licensee holds, there are other restrictions in place:

General insurance

- Licensees with an approved designation (CAIB, CIB, CIP [formerly AIIC], CCIB, FCIP and CRM) must have 4 continuing education credit hours

- Licensees who do not have an approved designation but have been licensed as a general insurance agent or salesperson for at least 5 out of the last 7 years in Canada must earn 6 continuing education credit hours

- Licensees who do not have an approved designation and who have not been licensed as a general insurance agent or salesperson for at least 5 out of the last 7 years in Canada must earn 8 continuing education credit hours

- No single course can be accredited for more than 8 hours

- No more than 7 credit hours can be earned in a single day

- If a course includes an exam, the student must pass the exam to receive the credit hours

- Excess credit hours cannot be carried over into the next licensing period

Adjusters

- Licensees with an approved designation (CAIB, CIB, CIP [formerly AIIC], CCIB, FCIP and CRM) must have 4 continuing education credit hours

- Licensees who do not have an approved designation but have been licensed as a general insurance agent or salesperson for at least 5 out of the last 7 years in Canada must earn 6 continuing education credit hours

- Licensees who do not have an approved designation and who have not been licensed as a general insurance agent or salesperson for at least 5 out of the last 7 years in Canada must earn 8 continuing education credit hours

- No single course can be accredited for more than 8 hours

- No more than 7 credit hours can be earned in a single day

- If a course includes an exam, the student must pass the exam to receive the credit hours

- Excess credit hours cannot be carried over into the next licensing period

Accident and Sickness (A&S)

- Licensees who hold an approved designation (CFP, CLU, RHU,FCIA,FLMI or CEBS) must earn 5 hour of continuing education credits

- Licensees who have been licensed as a life insurance agent for at least 5 out of the last 7 years but do not have an approved designation must have 10 hours of continuing education credits

- Licensees who have not been licensed for at least 5 out of the last 7 years and do not have an approved designation must obtain 15 hours of continuing education

- No single course can be accredited for more than 15 hours

- No more than 7 credit ours can be earned in a single day

- If a course includes an exam, the student must pass the exam to receive the credit hours

- Excess credit hours cannot be carried over into the next licensing period

Life Insurance

- Licensees who hold an approved designation (CFP, CLU, RHU,FCIA,FLMI or CEBS) must earn 5 hour of continuing education credits

- Licensees who have been licensed as a life insurance agent for at least 5 out of the last 7 years but do not have an approved designation must have 10 hours of continuing education credits

- Licensees who have not been licensed for at least 5 out of the last 7 years and do not have an approved designation must obtain 15 hours of continuing education

- Only technical material will qualify for continuing education. This includes education relating to:

- Life insurance products

- Financial planning, provided the education is geared towards life insurance and not a non-insurance sector such as securities or mutual funds

- Compliance with insurance legislation and requirements, including the Insurance Act, Council Rules, privacy legislation

- Ethics

- E&O

- Excess credit hours cannot be carried over into the next licensing period

- No course can be accredited for more than 15 hours;

- There is a daily maximum of 7 hours; and

- Where a course involves an exam, you must successfully pass the exam.

Licensees must ensure they have a valid record of course completion. These records must be kept for five years from the end of the licensing period from when the credit was obtained. The Insurance Council of British Columbia may conduct random audits. Licensees who lack proper records or documentation may face disciplinary action, including the invalidating of the license.

One hour of instruction is equal to one hour of continuing education credit, with a one hour minimum. Breaks are excluded from the hour and students must complete the course or the seminar.

Resource link: http://www.insurancecouncilofbc.com/publicweb/ContinuingEducation.html

May 24, 2016 | News

Hope you enjoyed your long weekend.

Now it’s back to work and back to mandatory CE requirement deadlines.

Hooray!

Don’t stress out just yet.

Yes there is just 1 week left till the May 31 mandatory CE credit deadline but with ILS your CE is FAST, EASY and DONE!

Get online and get to work. Purchase or renew your ILS CE Course Subscription and complete your CE requirements entirely online now.

ILS offers accredited continuing education courses for insurance agents and financial planners across Canada. Continuing Education deadlines for insurance agents in BC and Manitoba are May 31, and Alberta’s requirements must be met by June 30 this year. With an ILS CE Course Subscription immediately access hundreds of provincially accredited CE hours for one low cost.

Renew or Purchase your CE Subscription

Your CE Deadline Dates

MAY 31 – BC Life / General / Adjuster – MB Life / General

JUNE 30 – AB Life / General / Adjuster – MB Adjuster

SEPT 30 – ON General

Advantages of the ILS continuing education course subscriptions:

- Once you purchase your subscription, you can begin taking your courses immediately! If you are a new subscriber, you will receive an automated username and password by email.

- Access more than 180 accredited general insurance training courses in both text and streaming video formats, including personal lines, commercial lines, auto, farm, professional management and personal skills courses.

- Access more than 70 accredited life/A&S insurance training courses in both text and streaming video formats including errors & omissions insurance, money management planning process and insurance and estate planning.

- Have a digital record of your completed course work, which we keep on file for up to seven years.

- Save time by completing your general insurance continuing education requirements entirely online, no paperwork or commute.

- Courses can be accessed any time and you can log in and log out as many times as you wish during the course period.

- Quizzes and Final exams are offered in our courses to help you retain the information.

- Should you require any assistance at any time during your course work, we are here to support you 5 days a week, 0800 – 1700 PST.

Join the more than 22,000 Canadian insurance professionals who develop their skills with ILScorp each year!

May 11, 2016 | News

2 New Courses

4 New Provincially Accredited CE for Life and A&S Subscribers!

These courses are included as part of your ILS Life/A&S CE Course Subscription and are now available to all subscribers.

Introduction to Travel Insurance Medical and Dental Coverage Online Course and Introduction to Travel Insurance Life and Body Protection Online Course are each accredited for 2 life/A&S CE in BC, AB, SK, MB and ON.

Included as part of the ILScorp Life/A&S CE Subscription

Included as part of the ILScorp General Insurance CE Subscription

Included as part of the ILScorp Adjuster CE Subscription

Become an ILScorp group member to save even more

Introduction to Travel Insurance Medical and Dental Coverage Online Course

This course is designed for those needing to understand, or refresh their knowledge of the medical and dental coverage for those traveling.

Topics include:

- The need for insurance and travel insurance, along with an overview of its history and development over time.

- An overview of the common law duties associated with an insurance contract and the obligations that come with these.

- How Medical and Dental Insurance coverage minimizes the financial risks of travel.

- A look at the benefits and limitations of Medical Insurance coverage, its terms, conditions and examples of circumstances where it may prove beneficial.

- How Dental Insurance coverage benefits travelers, including examples of its use, and application of certain terms and conditions.

- The terms and conditions that apply specifically to Emergency Evacuation

- Insurance coverage, along with examples of situations where it has protected travelers.

- The terms and conditions governing Repatriation Insurance Coverage, along with examples of situations where it can protect an insured traveler.

- How Pre-Existing Insurance coverage aids travelers, including examples of its use, and application of certain terms and conditions.

Credit Hours: 2

Credit Type: Life/A&S or General/Adjuster – Technical

BC, AB, SK, MB, ON

Introduction to Travel Insurance Life and Body Protection Coverage

The course provides an overview of the various forms of protection that fall under the heading of Travel Insurance Life and Body Protection Coverage

Topics include:

- The need for insurance and travel insurance, along with an overview of its history and development over time.

- An overview of the common law duties associated with an insurance contract and the obligations that come with these.

- How Life and Body Protection Coverage minimizes the financial risks of travel.

- A look at the benefits and limitations of Life Protection Coverage, its terms, conditions and examples of circumstances where it may prove beneficial.

- How Body Protection Coverage benefits travelers, including examples of its use, and application of certain terms and conditions.

- The terms and conditions that apply specifically to Accidental Death and Dismemberment (AD&D) along with examples of situations where it has protected travelers.

- The terms and conditions governing Flight Accident Coverage, along with examples of situations where it can protect an insured traveler.

- How Security and Political Evacuation coverage aids travelers, including examples of its use, and application of certain terms and conditions.

Credit Hours: 2

Credit Type: Life/A&S or General/Adjuster – Technical

BC, AB, SK, MB, ON

May 9, 2016 | News

A new standard Ontario automobile insurance policy will come into effect on June 1, 2016. The new standard includes reductions in coverage particularly as they relate to the Statutory Accident benefits (SAB) from the current auto policy.

This information is intended to assist brokers in the development and implementation of a plan for communicating with their clients about the Ontario Automobile Reforms. Further, it is designed to provide guidance on receiving and documenting client instructions relating to auto coverage in light of these reforms. Your clients are entitled to your advice on their options under the new standard auto policy. The presence of a clear and consistent approach toward communication and documentation will enable a broker to demonstrate, if asked, that meaningful steps were taken to service their clients in a conscientious and

diligent manner.

ILScorp will have brand new course on the Ontario Automobile Insurance Reforms 2016 available soon.

Highlights Summary

- A new standard automobile insurance policy will come into effect on June 1, 2016.

- The new standard includes reductions in coverage particularly as they relate to the Statutory Accident benefits (SAB) from the current auto policy.

- Brokers are specifically encouraged to make all reasonable efforts to advise their clients of these changes.

- As policies renew after June 1st, brokers should be prepared to review with their clients how the changes will impact them.

- Brokers should ensure client files accurately reflect discussions and instructions received.

Background

As part of the Provincial budget announced on April 23, 2015, the Ontario Government has issued a number of automobile insurance reforms that will become effective on June 1, 2016. Of particular interest to brokers are a new Statutory Accident Benefits Schedule – Effective June 1, 2016 (“new SABS”). There are a number of other changes to related Regulations which will also be summarized in this document. This best practices document will focus primarily on the impact of the SABS reforms.

HOW THE REFORMS MAY AFFECT YOUR AUTO CLIENTS

The new standard Ontario automobile policy, to be effective June 1, 2016, includes several significant changes from the current standard policy including provisions that will result in lower coverage for clients.

SUMMARY CHART

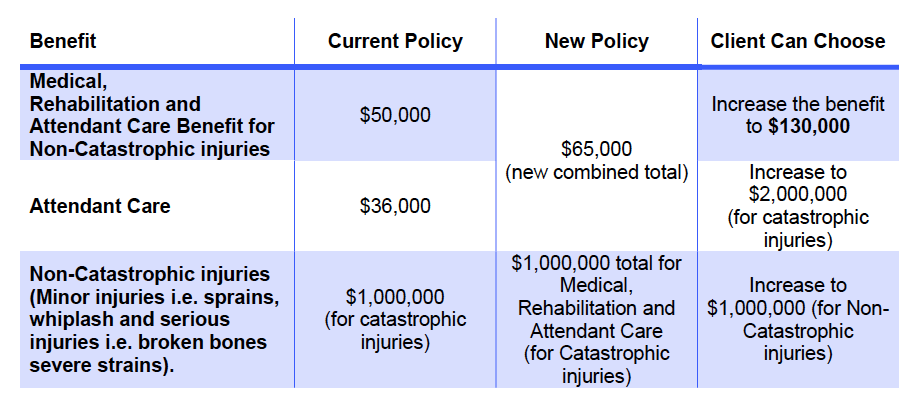

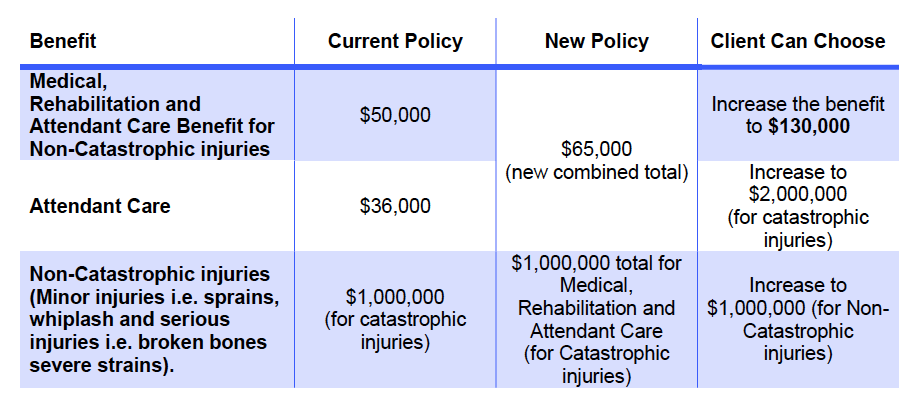

A Summary Chart of the most significant new policy changes that take effect on June 1, 2016, including the current policy provisions as well as consumer choices under the new policy, are set out below:

Most Significant Changes

On June 1, 2016, if a consumer is buying a new policy or renewing an existing one, brokers should be aware of the most significant changes to auto insurance:

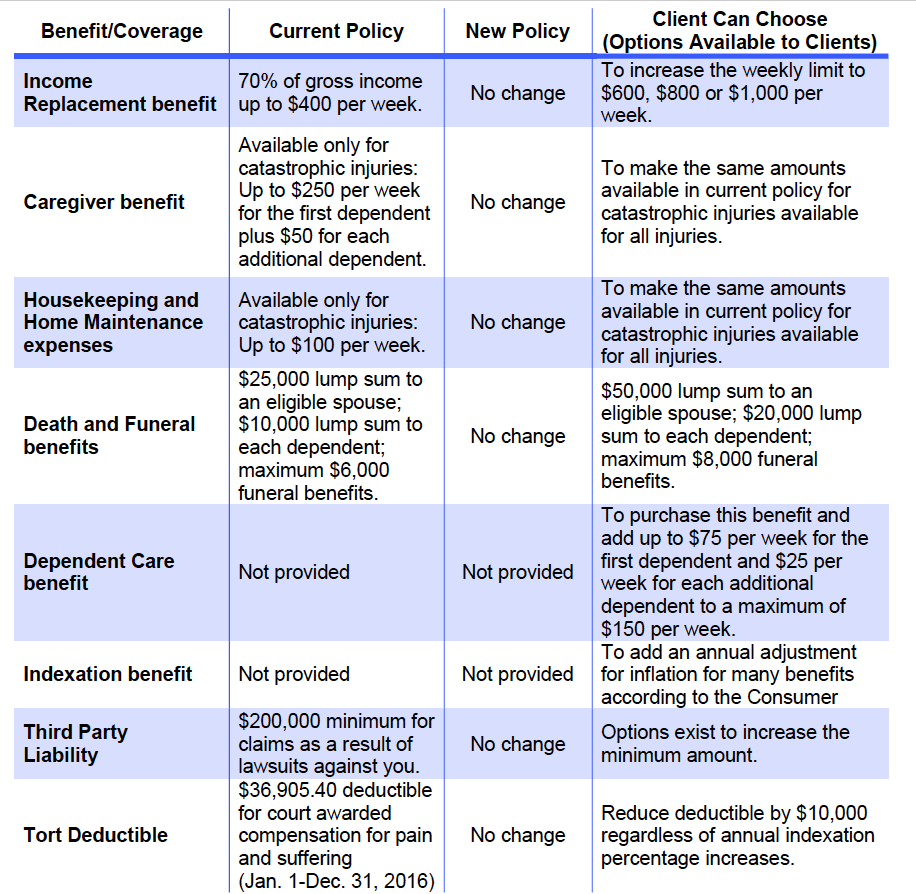

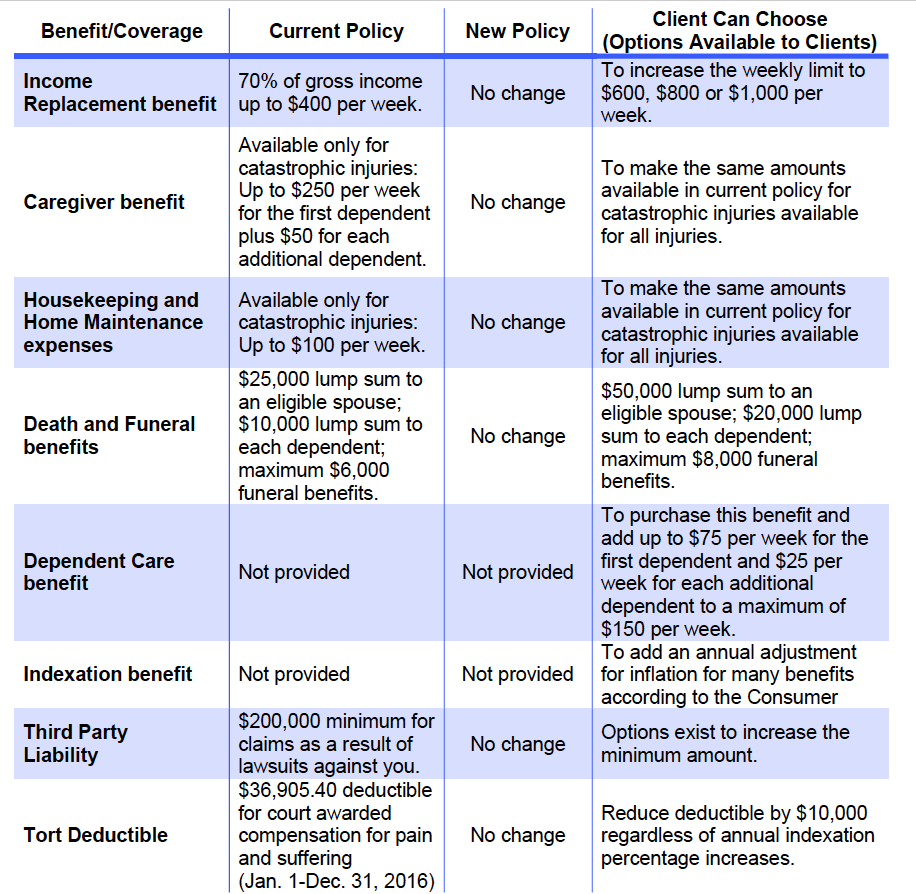

Some important things to remember about these choices:

Medical, Rehabilitation and Attendant Care benefits for minor injuries are fixed at a maximum limit of $3,500.

If clients purchase both the additional Medical, Rehabilitation and Attendant Care benefit for catastrophic injuries and for all injuries, the total eligible benefit amount for a catastrophic impairment would be $3,000,000.

Other Optional Benefits

There are many other options available to purchase additional or increased benefits and coverages. The following chart lists some but not all of those and indicates if those options will change on June 1, 2016. Clients can also choose not to increase any benefit or coverage. Brokers should let clients know if they had previously purchased any optional benefits. A further review of documents is required as they may have changed.

NOTE: This information is a sample summary and should not be relied upon to be exhaustive. For complete information follow this link:

DOWNLOAD FULL ONTARIO AUTO REFORM DOCUMENT HERE

ILScorp will have brand new course on the Ontario Automobile Insurance Reforms 2016 available soon.

May 2, 2016 | News

A BC Insurance Professional’s Regulatory Responsibilities

Ensure you and your staff remain compliant with the Insurance Act and the Insurance Council of BC’s requirements.

In this three part course you will be guided through the regulatory responsibilities expected of an Insurance professional in the province of B.C. This course starts out with an introduction to the Acts, statutes, and regulatory bodies that are empowered to oversee the insurance industry in BC and briefly addresses privacy issues.

Lesson 2 moves into the Rules that the Insurance Council of British Columbia has implemented in order to provide the administrative structure for provincial brokers and adjusters. These rules include licensing, educational requirements, individual responsibilities, the complaints process and disciple procedures.

Lesson three completes the course with a detailed look into the Council Code of Conduct and recent disciplinary rulings. Each lesson includes an exam to ensure the required level of comprehension has been met.

View Course

Credit Hours: 3 – BC ONLY

Credit Type: General/Adjuster – Life/A&S

Included as part of the ILScorp General Insurance CE Subscription

Included as part of the ILScorp Adjuster CE Subscription

Included as part of the ILScorp Life/A&S Insurance CE Subscription

Please note: this is NOT the mandatory “BC Council Rules Course” for BC individuals who obtain an insurance licence on or after March 1, 2016.

However, to ensure compliance with the Insurance Act and the Insurance Council of BC’s requirements, it is highly recommended this training be completed by all BC licensees.