ILScorp Blog

The latest and greatest info from ILScorp!Enjoy Your Easter Holiday Weekend

Where does the Easter Bunny get his eggs?

From Eggplants!

What do you call a rabbit with fleas

Bugs Bunny!

ILScorp offices will be closed on Good Friday, April 10, 2020. We’ll be back on Monday, April 13 ready to take your calls and answer your questions. You can also register for our insurance training programs online, anytime, at ILScorp.com. How do I register or renew my subscription for online insurance courses? To renew your subscription or register for an online course or CE Subscription simply…

New CE Course on Marijuana Grow-Ops

A Growing Danger, Risks of Marijuana Grow-Ops

This course provides students with an overview of the situation across the country with regard to the existence of Marijuana Grow Ops. Risks and hazards of these illegal operations are detailed in Lesson 2. An important discussion is presented of the issues these Grow Ops raise for insurance companies. The course provides advice for landlords both to avoid renting to questionable individuals, as well as to monitor their property for any signs of such activity that might come to light. A comprehensive assessment of the student’s grasp of the information is also provided.

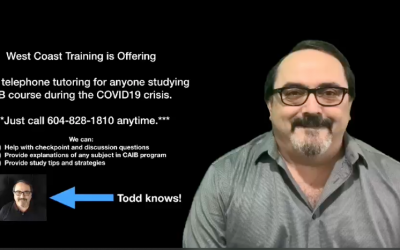

Free CAIB Exam Prep Tutoring Available with ILScorp Courses

The COVID-19 pandemic has changed the way many of us carry out our daily activities. Many brokers in Canada are now working remotely from home and many of you are also in the midst of preparing for your CAIB (Canadian Accredited Insurance Broker) examinations.

For those of you who are currently studying for your CAIB exam, or considering the next step in your CAIB designation, a complete set of online training videos is available to you through ILScorp.com. With ILScorp, you can access these online video CAIB exam prep courses 24 hours a day, anywhere you have an internet connection.

ILScorp is here to assist you with your studies

As the COVID-19 outbreak continues to evolve, we want to reassure you that we’re taking precautions to keep our customers and employees safe. Most staff are now working from home to help with social isolation.

ILScorp will continue to provide online educational programs and resources, and customer support services are available via phone, email, and chat.

How to Contact Us:

We encourage emailing us so we can assist you promptly!

info@ilscorp.com

Phone lines open Monday to Friday, 8:30 am to 4:30pm PST. Wait times may be a bit longer as we have gone down to 1 line, but please leave us a message.1.800.404.2211

Or, Chat with us on our homepage www.ilscorp.com

We understand this is an uncertain time for everyone, so whether you are considering a new career in insurance, or successfully continuing your online studies, we are here to assist you as best we can.

ALBERTA EXAMINATION CANDIDATES – CANCELLATION NOTICE

The World Health Organization has declared a global pandemic caused by the Coronavirus (COVID19).

The AIC is asking for your assistance in helping to contain the outbreak.

In order to ensure the safety of both exam candidates and staff, AIC asks for your cooperation. The AIC has decided to temporarily suspend all examinations for a 2 week period and will re-evaluate at that time.

What is the Alberta General Insurance Level 1 Data Validation Project?

Also known as GLQP, the project is intended to assist educators in tailoring course material/delivery to prospective general insurance level 1 examination registrants through providing success rates specific to each provider and course delivery method. The project aims to ensure consistent education delivery and to improve student success rates.

Alberta General Level 1 GLQP

s of January 01 2020, all students must study current educational materials from an approved General Level 1 Educator in order to be certified as having met the prerequisites to write the Alberta General Insurance Level 1 Licensing Exam. You can no longer challenge the Alberta General Level 1 Licensing Exam. This new certification format is known as the Level 1 General Licensing Qualification Program (GLQP). Why implement the General Licensing Qualification Program? The intention of candidate certification in order to register and write the licensing exam, is to ensure competency of new entrants into the General Insurance field. Low pass-rates have been an ongoing subject of concern with educators and industry stakeholders. A change in program approach is now being delivered to ensure consistent education delivery and to improve student success rates.

New Course Equivalencies For Alberta Level 1

The GIC has approved the following course equivalencies for the following levels of certificates of authority:

1) Alberta General level 1:

a. Proof of passing the Canadian Accredited Insurance Broker (‘CAIB’) 1 and 2 courses with proof that the last exam was passed within 12 months of the submission of an application for licensing to the AIC,

or

b. Proof of having the Full CAIB Designation with proof that the last exam was passed within 12 months of the submission of an application for licensing to the AIC.

PROETHICS – Second mandatory course in Compliance

If you are licensed with the CSF, the CSF ProEthics course must be completed by November 30th, 2019.

This mandatory online training course is only offered and available on the CSF’s website.

The PDUs related to the CSF’s mandatory course on compliance ProEthics can only be awarded once during the two reference periods covered by the course, that is, between the launch of the training activity in November 2016 and the end of the current period on November 30, 2019.