Jan 30, 2014 | News

Looking for a career with a future? Consider insurance. While automation may claim as many as 47% of current jobs by 2033 according to a recent Oxford University study, the insurance industry is growing and more people will be needed.

According to Statistics Canada, more than one million Canadians were employed in the insurance and financial sector in 2012 – and there’s always room for more. Think about it; that’s one million Canadians gainfully employed and enjoying a rewarding insurance career!

The insurance industry is still expanding, with more opportunities for newcomers to the industry. Consider these facts from Insureconomy, a review of the insurance sectors in Ontario, New Brunswick and Nova Scotia:

- From 2004 to 2010, total employment in the insurance industry across New Brunswick grew by 49 percent – faster than all other provinces in Canada.

- The insurance industry has been growing steadily in Ontario since 2005, with insurance carriers increasing their workforce by 18 percent. Overall, the insurance industry increased total employment by over 12 percent – well above the provincial employment growth rate of only 4 percent.

- Direct employment in Nova Scotia’s insurance industry has been on the rise since 2005. From 2005 to 2008, 655 new jobs were created by the insurance industry.

If you’re planning a career that spans beyond the next decade, you may want to strike the following jobs off your list. Why?

“In the future, it’s very likely that many of today’s jobs, from cashier to teller, will be automated and the need for real people to take on these roles won’t be needed as technology will catch up and take on these responsibilities,” says Scott Dobroski, Glassdoor community expert.

“Themes people should be aware of include low-skilled jobs being likely replaced by automation first, such as telemarketer or typist, whereas jobs requiring creativity or a social aspect to them are not as at risk.

Bank Teller

When was the last time you used the services of a human bank teller? Chances are, unless you had to perform a complicated transaction, an ATM got the job done. Mark Gilder, director of distribution strategy at Citibank, told MarketWatch recently that “at least 85% of the things you can do at the teller, you can do at the ATM.” Citibank is experimenting with video-based tellers and ATM-based loan applications in Asia.

Cashier

Cashier seems like an obvious example of an occupation that can be replaced by a machine. If you’ve been to a grocery store recently, you’ve doubtlessly noticed the rise of self-checkout machines. Indeed, the number of self-checkout machines may be as high as 430,000 worldwide — more than quadruple the number in 2008.

Receptionist

Thrifty companies can now avoid hiring someone to answer the phones thanks to software programs Virtual Receptionist, while others are being outsourced by the likes of Davinci Live Receptionist. Meanwhile, in Japan, some have also experimented with actual robots. As consumers know, though, getting your call routed to a machine is off-putting, which is one reason receptionists aren’t being replaced en masse — yet.

Telephone operator

Telephone operators — defined as people who answer phones for companies and overnight call service like doctors and so on — are a vanishing species thanks to outsourcing and ubiquitous automation. Yet Recruiter.com predicts a slight increase in jobs in the category over the next few years.

Mail carrier

Email is causing the overall amount of snail mail to drop — there were 171 billion pieces delivered in 2011 vs. 2010 the year before — and the U.S. Postal Service is having major financial problems. The combination has prompted the BLS to forecast a 28% decline in mail carrier jobs through 2022. Canada Post is also facing massive cuts as it continues to lose money.

Travel Agent

Years ago, there was no Expedia or Orbitz. To book a flight somewhere, you had to visit a travel agent, who would presumably get you the best deal possible. These days, many view the occupation as superfluous, which is why the BLS is forecasting a 12% decline is such jobs by 2022.

Typist

Can you picture a modern CEO telling his secretary to “take a letter”? Perhaps. But in these days of blogging CEOs and voice-recognition software, the notion is increasingly antiquated.

Newspaper reporter

Blogs plus aggregation services like Google News are making the average consumer less reliant on newspapers. As a result, the number of newspapers is dropping.

Data Entry Associate

Software has also mimicked data entry, obviating the need for humans to perform the job.

Telemarketer

Few will mourn their passing, but telemarketers are increasingly being replaced by robocalls, which can do the job 24/7 and maintain their perkiness no matter how many times consumers hang up on them.

So, still wondering if insurance is a good career choice? With ILScorp you can be licensed and ready to start working in just weeks or months, with no need for years of schooling. With a number of insurance licensing options, depending on which province you live in, ILS can get you licensed, or help you prepare to write your province’s licensing exam.

Jan 29, 2014 | News

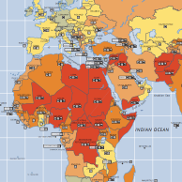

Risk Management company Aon has released its 2014 Terrorism and Political Violence Map to help organizations assess risk levels of terrorism and political violence across the globe.

Produced in collaboration with global risk management consultancy, the Risk Advisory Group plc, the map indicates that Brazil was the only Latin American country to see its risk rating increase from medium to severe due to widespread and large-scale violent anti-government protests throughout 2013. The analysis indicates this unrest will likely continue in 2014, particularly ahead of the FIFA World Cup and the October general elections.

When looking at attacks on businesses by sector, the retail and transportation sectors were significantly affected in 2013, with 33 percent of terrorism attacks affecting the retail sector, and 18 percent of attacks taking place on the transportation sector. The retail sector includes venues such as public markets, which remain vulnerable to attack as seen last year in Kenya. Terrorism remains a variable threat in the Eurasia region, with Russia and Turkey the most affected by the threat through 2013. Additionally, the Winter Olympics in Russia, which will involve significant mass transportation moves, is seen as a potential terrorist target.

Despite some improvements in the ratings – eight decreases and just one increase – to the 37 country scores that cover Sub-Saharan Africa in 2014, Africa remains a continent of high political violence and terrorism risk, with 22 countries having high to severe risk ratings.

Empirically, the Middle East is the region most afflicted by terrorism in the world, with a 28% share of all terrorist attacks recorded worldwide in 2013. A new strain of Salafi Jihadism has emerged in the Middle East and North Africa (MENA) region as evidenced by increased levels of terrorism. This is a cause and effect of the limited political recovery of post Arab Spring countries, and has contributed to widespread high-to-severe risk ratings across the region.

The data shows:

- 34 countries attained reduced country risk scores.

- Four countries attained increased country risk scores – Brazil, Japan, Mozambique and Bangladesh.

- In contrast with other regions, Europe saw notable improvement with 11 countries having civil commotion perils removed.

- Brazil was the only Latin American country to receive an increased risk rating.

- Overall country scores for Asia Pacific and Oceania region remain broadly stable with only four changes out of 29 countries and territories – South Korea, Malaysia and Samoa all attained reduced risk ratings – while increased military spending and geopolitical tensions in Japan increased the country’s rating.

- 33% of all high and severe risk countries globally are in sub-Saharan Africa.

Neil Henderson, head of Aon Risk Solutions’ Crisis Management Terrorism team, said, “Having unrivalled access to regional data and fact-based insight enables our global clients to begin planning ahead of these trends by performing necessary risk identification and consider preventive risk management solutions. This insight allows our clients to plan overseas expansion or international growth and supports them in their efforts to be resilient to a terrorist or political violence threat.”

Ian Nunn QGM, head of Aon Risk Solutions’ Crisis Consulting team, added, “Clients are naturally keen to penetrate key economic markets around the world, and seek highly attractive opportunities where they can maximize greater returns from their investments. It is important for businesses to recognize that this will also pose significant new political, security and operational risks that will have to be combined with tough regulatory and legislative pressures. A clear understanding of exposure and risk including the possible rapid change in the political and security situations within their operating regions is necessary to ensure appropriate mitigation measures are in place to manage such exposure. The Terrorism Risk Map is one of the key components of Aon’s global WorldAware Safe Travel Solutions to assist clients in understanding and managing global risk.”

The map measures political violence and terrorism in 200 countries and territories to help companies assess the risk levels of political violence and terrorism.

Jan 28, 2014 | News

Canadian drivers are increasingly researching their vehicle insurance options online before visiting their insurance agent or, also increasingly, purchasing their insurance directly online.

Insurance agents need to be educated on the options available to consumers, and be able to present the advantages of dealing with them over making online purchases. Meanwhile insurance companies are seeking to make it easier for consumers to purchase directly from them.

A new competitor has recently entered the Canadian market. Drivers in Canada now have a new way of discovering Canadian insurance agencies, by using the Auto Pros company website. A new group of Canadian auto insurance policy providers have joined the online quote centre setup.

The Canadian companies that are currently available for research online are now able to quote motor vehicle policy plans. Every provider that is represented in the international system has the ability to quote prices based on the location of each driver.

This new and simplified way of obtaining pricing is a recent upgrade to the Auto Pros services this year. The inclusion of American and Canadian agencies in the lookup system is extending the research options for different policy types that drivers use most often for vehicle protection.

The Canadian provider agencies now found in the research system has increased the numbers of policies that drivers can review. Apart from basic insurer protection, policy types that can be customized are offered by select agencies and quotes are now presented online.

ILScorp offers vehicle insurance courses for agents working in BC and Ontario. Two ICBC Autoplan courses are now available at both beginner and advanced levels. Both courses review: ICBC Autoplan coverages and exclusions; accident benefits; underinsured motorist protection; hit-and-run & UMP; third-party liability; and what ICBC covers. The ILScorp Certified Ontario Auto Expert Course leads you through the coverage, common client concerns and questions, errors and omissions avoidance, options, and important considerations in giving advice about private automobile coverage in Ontario.

Stay informed and enhance your professional skills with continuing education courses from ISLcorp.

Jan 27, 2014 | News

Congratulations to all of our Share and Win prize winners. Thank you to everyone who visited our Facebook page, to share with us what you want to learn in 2014. See all of the entries on Facebook.

It was a pleasure for us to hear from you that ILScorp has the courses that you want to take to expand your professional horizons this year. Whether it’s earning your insurance license or more designations, improving your professional skills or gaining experience in specific areas of insurance, ILScorp is here to help!

Congratulations to the following winners, who shared what they want to learn in 2014:

- Tracy Harnden Johnson: “I would like to get my designation.”

- Carolyn Suttle: “I want to learn how to study and pass my CAIB exams easier in 2014. My old brain needs help. I’ve attempted many times without success and have heard from many that your program is the best way to go.”

- Lesley Barrie: “I want to learn more about the management side of insurance and therefore, look forward to taking CAIB4.”

- Julia Mary Corsie: “I want to learn more about personal lines and to pass my CAIB 2 in 2014!!”

- Heather M. Sweetman: “I want to learn the skills to write a long answer exam, specifically CAIB1”

Each of our five winners will have $500 to spend on their choice of ILScorp online insurance training. They can choose from a subscription to our Continuing Education catalogues, the ILS introduction to General Insurance Licensing Program, our CAIB exam prep courses, and more.

We will contact each of our winners on Monday Jan. 27. CONGRATULATIONS!

Jan 24, 2014 | News

It’s the last day to share and win with ILScorp. We want to know what you want to learn in 2014, and give you the chance to win your choice of courses from ILScorp!

We’re excited to hear what you want to learn. From general ideas, to specific courses, agents across Canada know they can benefit from online insurance training from ILScorp. The entires are showing a huge variety of interests, and we know ILS can help!

Jenna F. tells us she wants to “learn my commercial insurance basics so I can move on to more complicated things, as I have been given the chance to start my career with an awesome company,” while Charlene S. says she wants to “learn more about claim outcomes and settlements.”

Angele C shared that she wants to “learn to be an expert in marketing in 2014.”

Debbie is excited to complete the ILS Introduction to General Insurance: “I work in a insurance office doing the motor vehicle and have attempted the fundamentals book as it was really difficult to understand. A few of my co-workers have completed the ILS course with great success, and the book was fun and easy to read. I would love to have the opportunity to complete it with this course. I am so motivated to try this!!”

Meanwhile Cathy P. says she wants “I want to learn to more….. just more.”

What do you want to learn in 2014? Let us know on our Facebook page which skills or subjects you’d most like to learn this year by filling in the blank: I want to learn ___________________ in 2014.

Whether you’re ready to begin your career in insurance, looking to upgrade your license, increase knowledge in specific areas of insurance, or learn business skills including time management and leadership, ILScorp has online courses to help you improve your professional life. Regardless of your goals, you’ll find online insurance training to suit your needs.

Share your answer on our Facebook page today, and you could win the chance to “learn more and earn more” with ILS. To help you achieve your 2014 learning goals, we’ll select contest five winners from these comments, who will receive up $500 worth of ILScorp online courses. Contest entries must be received by Jan. 24, 2o14.

Winners receive an ILScorp subscription or ILScorp course valued up to $500. All prizes must be redeemed by May 1, 2014.

* No cash value. Does not apply to previous purchases. Is not transferable to another person.

Jan 22, 2014 | News

As temperatures plummet again in eastern Canada, and the snow continues to fall, it’s a great time to review and share 10 important winter driving tips. Share these winter driving tips with your insurance clients and help keep everyone safe on the road.

1. Avoid the winter slip ‘n’ slide: It’s well past the time to switch your all-season tires to winter ones (this should be done before the temperature drops below 7°C). Winter tires optimize the performance and safety of winter driving. Not convinced you need them? Consider that the braking distance of a winter tire could be up to two vehicle lengths shorter than the braking distance of an all-season tire rolling at 24 km/h. There is still plenty of winter driving weather ahead.

2. Defrost your windows well: Neglecting to defrost your windows might get you to your destination faster, but it’s a dangerous habit. Plan for a few extra minutes to clean all your car’s windows well. And don’t forget to clear off the top of your vehicle—snow could slide down the windshield and obstruct your view while the vehicle is in motion.

3. Winterize your trunk: Keeping a roadside safety kit in your trunk year-round is a good idea, but winter driving conditions require extra safety equipment. Make sure you’re carrying a scraper for the windshield, a small shovel, a sandbag, candles, and warm clothing like gloves and a hat. Be prepared if you have to get out of your car in cold weather.

4. Replace worn tires: It’s important to check your tires each winter season because worn or bald tires can be dangerous. Tires have tread wear indicator bars molded into them. A solid bar of rubber across the width of the tread means it’s time to replace the tire.

5. Don’t mix and match: Mixing tires with different tread patterns, different internal constructions and/or different sizes compromises the stability of the vehicle. Ensure your vehicle is equipped with four identical winter tires.

6. Top up your fluids: Always keep your gas tank at least half full. On very cold days, the condensation in the tank can freeze and cause problems. Also, don’t forget about your windshield-washer fluid – this is also extremely important on those sunny day!

7. Pump up your tires: For every 5°C drop in temperature, tires lose one pound of air pressure. To ensure optimum fuel efficiency and prevent irregular or premature wear, tire inflation should be checked monthly.

8. See and be seen: It is critical for drivers to see and be seen in low light conditions, and when blowing snow impairs visibility. Always drive with your headlights on.

9. Take a cellphone: For long trips, don’t forget to take a cellphone in case you need to call for help. Pull over to the side of the road and stop your vehicle before making the call.

10. Drop your speed to match road conditions: The posted speed is the maximum speed under ideal conditions. In winter, it is safer to drive below the posted speed. No matter how much experience you have, the way your car will move on snow or ice always has an element of unpredictability.

Are you an insurance agent looking for a greater understanding of vehicle insurance in your province? ILScorp has online courses for ICBC Autoplan Agents in BC and an Ontario Auto Expert continuing education course. Visit ILScorp.com to learn more about our online continuing education courses for insurance agents.