Jun 26, 2015 | News

ILScorp offers hundreds of online insurance training courses, as well as specialized communication courses, leadership and management programs and more. And with new courses being added on a regular basis, here’s a look at some you may have missed:

1. Adjusting Bodily Injury Claims Course Series: Considering a career in adjusting bodily injury claims, or want to further your knowledge and understanding of the adjusting bodily injury process? Start learning with Module 1 through 4: Introduction and the Investigation Process; Injury Explanation and Details and Determining Liability; Introduction to Anatomy: Skin and Muscles; Muscle Strains and Skeletal Make Up, now available, with Module 5: Fractures and the Spinal Column, coming soon. These interactive online courses are available for individual purchase, with the entire series included as part of your ILS General CE Course Subscription and ILS Adjuster CE Course Subscription.

2. Certified Ontario Auto Expert & ICBC Autoplan: Yes, they are separate courses, but for agents working in BC and Ontario, understanding auto insurance is a critical part of the job. The Ontario Auto Expert Course leads you through the coverage, common client concerns and questions, errors and omissions avoidance, options, and important considerations in giving advice about private automobile coverage in Ontario. ILScorp also has 2 new ICBC courses: Introduction to BC Autoplan Insurance provides new orientation training for those wanting to learn more about ICBC’s Autoplan insurance in BC, while ICBC Autoplan Coverages and Exclusions provides in-depth insurance training on ICBC’s Autoplan insurance coverage and exclusions. Both courses review: ICBC Autoplan coverages and exclusions; Accident benefits; Underinsured Motorist Protection; Hit-and-Run & UMP; Third-party liability; and what ICBC covers.

3. Understanding Workplace Bullying: Two courses, one designed for employees, and another for employers, tackle the issue of workplace bullying and help your company become compliant with existing laws. Ontario, Manitoba, Québec and Saskatchewan have already introduced legislation against bullying and B.C. recently enacted Bill 14 [Workers Compensation Amendment Act] to address the effects of bullying at work. Up to 40 percent of Canadian workers report feeling bullied at work. What does this mean for you and your business? The courses are available as part of the General Insurance Course subscription or they can be purchased individually.

4. Saskatchewan Approved Accredited Ethics Courses: Get your Insurance Council of Saskatchewan approved mandatory ethics training courses and earn Continuing Education credits at the same time with these ILScorp Ethics series: Ethics and the Insurance Professional Courses (Parts 1-3) – now included in your general subscription, and Life Ethics in the Insurance Industry (Parts 1 -3) – included in the the life subscription bundle.

5. Secrets for Exceptional Speaking Course: Learn the techniques to communicate effectively and connect with your clients, customers, co-workers and family. Know how to bring your words to life with appropriate emotion with this innovative approach to presentation and communication skills. Enhance your reputation and relationships, improve your self-confidence and advance your career with the Secrets for Exceptional Speaking online course.

With more than 23,000 insurance professionals training with ILScorp every year, we are the leader in online insurance training in Canada. And with an ever expanding catalogue of courses, you’ll find relevant and informative courses for your business at ILScorp.com. Visit the website and get started today.

Jun 25, 2015 | News

Just when you were starting to calm down from your CE credit deadline stress mode…. yes Christmas is exactly 6 months away.

That being said, take your current schedule you are juggling now and imagine adding Christmas shopping, Christmas parties, and holiday travel all at once.

Boom! Merry Christmas.

I suspect you’ll thank yourself come mid-December if you use the extra time you have now to get ready for Christmas 2015.

Start Saving in the Summer

We all know Christmas is expensive. You really only have two options, spend less this year, or learn more and earn more money. Neither option is instantaneous, but financial experts recommend you start setting aside funds for your holiday plans as soon as your summer vacation has ended. Decide how much you need for your Christmas celebrations, and then begin saving a little each month to avoid panic in December. When consciously saving towards a targeted goal, starting earlier means you actually have to save less per month than if you start later. Most people will never plan ahead and will complain about how they never have any money. This is true of Christmas gifts and life in general.

Make and Address Christmas Cards in the Summer

Up to 30 percent of families say that running out of time close to the holidays is why they don’t send out Christmas cards. Have them made in the summer and then address them early on to avoid hassles.

Shop for Family Presents Early

Whenever possible, buy the majority of presents as early as possible. Labor Day sales in the beginning of September are often the best time to shop for clothing and toys.

Ultimately, those who are prepared for the holidays can spend less time worrying and more time enjoying the Christmas season with friends and family.

Jun 22, 2015 | News

Its Monday, and for many of us, the beginning of our work week.

Once upon a time you loved going to work every day. You no longer feel the same way. In fact, your feelings are the opposite of that. You can’t stand doing your job anymore. You’ve tried changing employers but it hasn’t helped at all. Maybe it’s time to change careers so you can once again enjoy going to work.

The average person can expect to change careers several times in his or her lifetime. One reason for all these career changes is that people often don’t make informed decisions when choosing an occupation. They neglect to learn about their own interests, work-related values, personality types and aptitudes in order to find out what occupations are suitable. They also do little to explore the careers they are considering and therefore don’t know as much as they should about them.

Making an informed decision regarding your career will certainly increase the likelihood that you will be more satisfied with it. There are, however, no guarantees. You may follow all the steps that should help you choose a career that is right for you but it may not remain your best choice forever. You may find yourself wondering whether you should be doing something different. Here are some valid reasons to leave your current career for a new one.

You Might Consider a Career Change If …

Your Life Has Changed: When you chose your career your life may have been different than it is today. For example you may have been single then and now you have a family. The crazy schedule or the frequent travel that is typical of your career may not suit your new lifestyle. You should look for an occupation that is more “family friendly.”

The Job Outlook in Your Field Has Worsened: The future looked promising for your field when you entered it. Due to changes in technology, the economy, or the industry you work in, job opportunities are no longer plentiful and your research indicates that things are going to get worse instead of better. You should look for an occupation that has a better outlook.

You Are Experiencing Job Burnout: Simply put, you just can’t stand doing your job anymore. You’ve tried changing employers but it hasn’t helped at all. It’s time to change careers so you can once again enjoy going to work.

Your Job is Too Stressful: Some occupations are inherently stressful. You knew that from the beginning about yours. You’ve come to a point, though, when it’s become too much to handle. To preserve your mental and physical health, you will have to find a career that is less stressful.

Your Work Bores You: When you did your initial research the occupation you ultimately chose had a lot of advancement opportunities. You’ve been working in the field for a while and you’ve climbed up the ladder while happily facing all the challenges you’ve encountered along the way. Unfortunately you’ve gone as far as you can. You are no long challenged by your work. A career change can help revitalize your motivation.

You Want to Earn More Money: If you dream of making more money, you may be surprised to learn that doing so won’t necessarily bring you job satisfaction. If you definitely can’t live the way you want to on your current salary and there is no way you can get a raise, you should probably make a career change. Choose an occupation that has higher earning potential.

Source: About.com

If you are considering a career change, perhaps the possibility of becoming an insurance professional interests you. The insurance industry is an industry full of promise and potential.

In becoming an insurance professional, you have the opportunity to engage and help prospects every single day. Its about showing people they can take control of their lives. The role of the insurance professional is no longer just about providing information, but about helping consumers weed through information, to help identify needs and provide solutions.

Take the first step towards an exciting and enriching career in the insurance industry by obtaining your Level 1 General Insurance License, with ILScorp’s Introduction to General Insurance Level 1 Licensing Program.

The ILS Introduction to General Insurance Level 1 Licensing Program (IGI) has over an 80% pass rate due to the adaptable learning styles available.

Choose from an easy-to-follow text book, online text or video instruction, study aids, virtual classrooms or even live immersion training.

Jun 18, 2015 | News

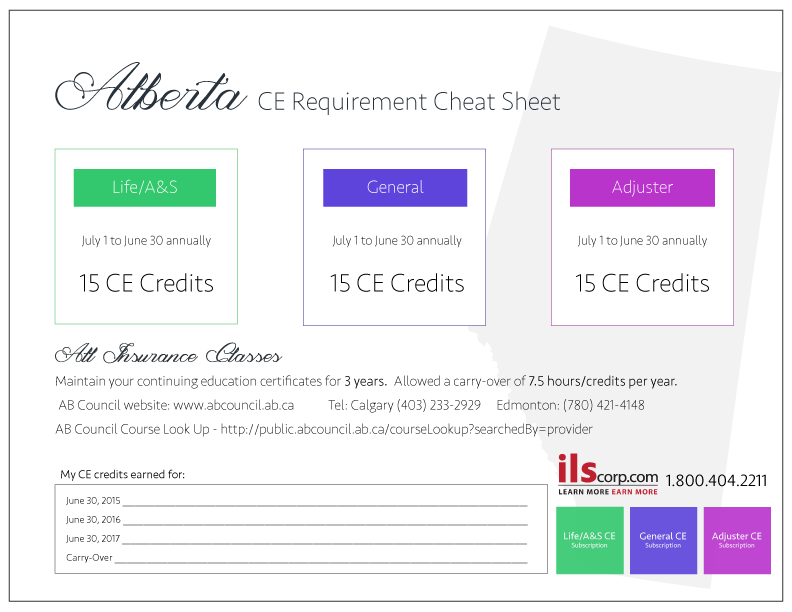

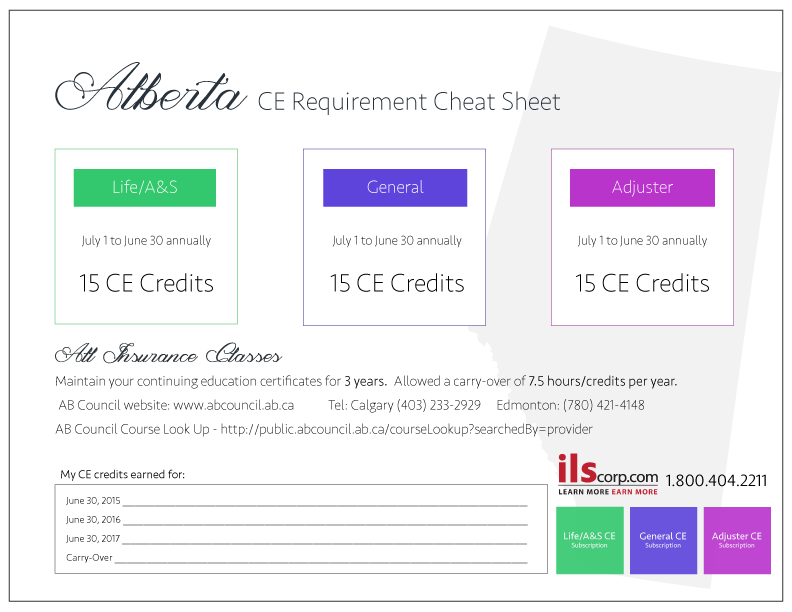

So it’s been a few years now that all insurance classes in Alberta have merged to a harmonized continuing education deadline of July 1 – June 30th annually.

Now that you’ve almost gotten used to the June 30 date, do you remember how many CE credits/hours you’re required to obtain, or allowed to carry over each year?

How long do you have to hold on to your continuing education certificates in case of an Alberta Insurance Council audit?

Your Alberta CE requirement information for each insurance class is all right here for you in this Alberta CE Requirement Cheat Sheet. We have included a notes section to help you easily keep track of your completed CE each renewal, because there is nothing worse than realizing on June 29 that you actually only have 10 CE credits instead of the required 15 CE credits! (As an insurance professional in Alberta, upon renewal you are required to declare that you have obtained the required number of hours. The Alberta Insurance Council may conduct random audits that may extend back 3 years.)

Alberta Insurance Council phone numbers, website and even the AIC# course look up URL, is also listed.

(Just a reminder, when you are entering the AIC# on the Alberta Insurance Council course look up page, be sure to enter the number ONLY, not the word “AIC “or the # sign with it.)

And of course we have listed the ILScorp website and phone number for quick access to our live operators, ready to assist you with your continuing education requirements.

Still need CE for your June 30 CE credit Deadline?

Click on your insurance class below to learn more about the ILS CE Course Subscription Options.

Jun 16, 2015 | News

Registering for an online CAIB 1, 2, 3 or 4 exam.

CAIB 1-4 online exams are available at the IBABC office in Vancouver BC, and also in major centres in cities around British Columbia such as:

- Campbell River – North Island College

- Cranbrook – College of the Rockies

- Castlegar – Selkirk College

- Kelowna – Okanagan Community College or UBC Okanagan Campus

- Kamloops – Thompson River University

- Nanaimo – Vancouver Island University

- Prince George – College of New Caledonia

- Vernon – Okanagan Community College

- Victoria – Camosun College

Exams must be conducted on weekdays between 9am and 4:30pm.

Students must have their proctors fill in the proctor nomination form with the details of the CAIB exam proctor, location, date and time. Students must read, sign and date the form and submit for IBABC approval a minimum of 72 hours prior to the exam date. More info

- Exam consists of multiple choice, definition and short answer questions for CAIB 1-3 and the long form answers for CAIB 4

- Students have 3.5 hours to complete the exam.

- The passing grade is 60% for each level.

- CAIB online exam marks will be available 7 days after the day students completes the exam and will be provided by email.

- The cost of the exam is $395.

- The cost to re-write the exam is $195.

Examinations may be re-written for a fee applicable each time. You may write an exam three times in a row but will then have to wait six months before a further attempt will be recognized by the Insurance Council of BC if the exam is being written for licensing purposes. Source: IBABC

ILScorp ONLINE CAIB EXAM PREP COURSE

Prepare to successfully write your CAIB Exam and work towards your CAIB designation with ILScorp’s CAIB Exam Prep Online Video Courses!

The RIBO Level 1 License allows you to sell Habitational (personal and commercial) Insurance Coverages, Auto Insurance Coverages, Travel Insurance, and Liability Coverages in Ontario.

Read more