Jun 21, 2016 | News

This course is included as part of your ILS General CE and/or Adjuster CE Course Subscription and qualifies for 1 continuing education hour of credit.

Alberta Insurance Adjusters and Alberta Insurance Brokers: AIC# 42949

Wawanesa Habitation Wording Update

The Wawanesa Habitation policy wordings are reviewed on a regular basis to ensure that the wordings are clear and consistent with Wawanesa’s underwriting and claims intent. In many instances, the Insurance Bureau of Canada (IBC) Advisory wordings were adopted. The wordings consist of two sections: Section I – Property Coverage and Section II – Liability Coverage. This wording booklet is also applicable to the habitational portion of Farm risks and is contained verbatim in ‘Your Farm Insurance Policy’

The policy wordings are reviewed on a regular basis to ensure that the wordings are clear and consistent with our underwriting and claims intent. In many instances, the Insurance Bureau of Canada (IBC) Advisory wordings were adopted.

The purpose of this learning opportunity is to highlight the changes that were made to the wordings effective January 1, 2015. It is not meant to cover all aspects of Habitation coverages.

Topics include:

- Definitions, Property Coverages

- Additional Coverages

- Additional Coverages – Condos

- Additional Coverages – Tenants

- Forms

- Peril Highlights

- Section I – Optional Coverages

- Section I – Loss or Damage Not Insured

- Section I – Conditions

- Section II – Liability Coverage

Included as part of the ILScorp General Insurance CE Subscription

Included as part of the ILScorp Adjuster CE Subscription

Become an ILScorp group member to save even more

Credit Hours: 1

Credit Type: General/Adjuster – Technical

Accrediting Provinces: BC, AB, SK, MB, ON

Credit #: AIC# 42949; MB# 26233

It is recommended that you download ‘Your Personal Insurance Wording 2015’ from the resource tab located in this online course. The wording booklet will be a valuable tool as you continue with the online course.

Course Definition Sampling:

Here is an example of some definitions that are new to the Wawanesa wording booklet:

“Aircraft” is newly defined and includes, airplanes, helicopters, hot air balloons, drones, unmanned aerial vehicles (UAV) and hovercrafts. It is important to include UAVs and drones in the definition to reduce ambiguity. In the past the common language definition of aircraft was relied upon. Over time technology has changed and by providing a proper definition it adds clarity to the intent of what is meant to be covered.

“Pollutant” means any solid, liquid, gaseous or thermal irritant or containment, including but not limited to fuel oil, vapour, soot, chemicals, pesticides, herbicides, waste and smoke from agricultural smudging or industrial operations. The addition of Pollutant to the Homeowner wording ensures consistency with the the Farm wordings, which previously contained this definition.

“Spouse” used to be embedded in the definition of Insured and Residence Employee. Spouse is now defined to closely follow the Ontario Family Law Act, which has been vetted by the Supreme Court of Canada.

“Surface Waters” means water or natural precipitation temporarily diffused over the surface of the ground, not caused by “flood” or escape of water from a “domestic water container” or “watermain”. The concerns regarding surface waters has increased due to catastrophes over the last few years and needed to be addressed.

“Watermain” means a pipe forming part of a water distribution system, which conveys consumable water but not waste water. This is an important definition when discussing the water exclusion that will be addressed later.

The following definitions have been revised from the previous version of the booklet.

“Business” has been clarified to read “the continuous or regular pursuit undertaken for financial compensation, including any trade, profession or occupation”.

“Computer Software” and “Software” have been combined under one definition; and means computer programs and/or instructions stored on electronic media, excluding video games of any kind

“Dwelling” has been expanded to include: ‘…described on the Declarations wholly or partially occupied by you as a private residence’

“Vacant” and “Vacancy” has been a contentious issue within the industry and there have been many prominent court cases on the issue. To clarify the issue further, the wording has been revised to:

Referring to the circumstance where, regardless of the presence of furnishings:

a.All occupants have moved out with no intention of returning to reside continuously in the dwelling and no new occupant has taken up residence OR

b.Where a newly constructed or acquired dwelling, no occupant has yet taken up residence

Jun 17, 2016 | News

Insurance reporting to Fire Commissioner’s office re: Fort McMurray Fires

Source Alberta Insurance Council and the office of the Fire Commissioner

Recognizing the burden the normal reporting system (Form 1242) would place on insurers and adjusters, the Office of the Fire Commissioner (OFC) has developed an abbreviated insurance loss system to capture fire loss data associated with the Fort McMurray fires. The OFC has developed a mapping solution that will allow companies to add the total fire loss and the loss payable by insurers. No other information will be required.

Regional Municipality of Wood Buffalo (RMWB) Fire Insurance Reporting

Background

The Safety Codes Act: Administrative Items Regulation (2004), sections 8, 9, 10 refer to the mandatory requirement for a municipality to report a fire that causes a fatality, injury or dollar loss to the Office of The Fire Commissioner (OFC). Section 11 refers specifically to insurers to report fires for which “that company is interested as insurer”.

Based on previous experience with mass loss reporting after the 2011 Slave Lake wildfire; the OFC has developed a faster and more readily accessible reporting tool. The OFC is aware of the enormous task of reporting all loss fires in the RMWB following the recent wildfire.

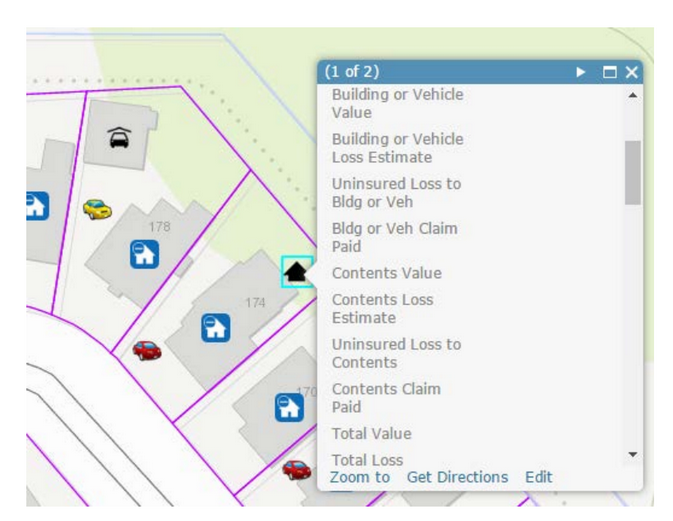

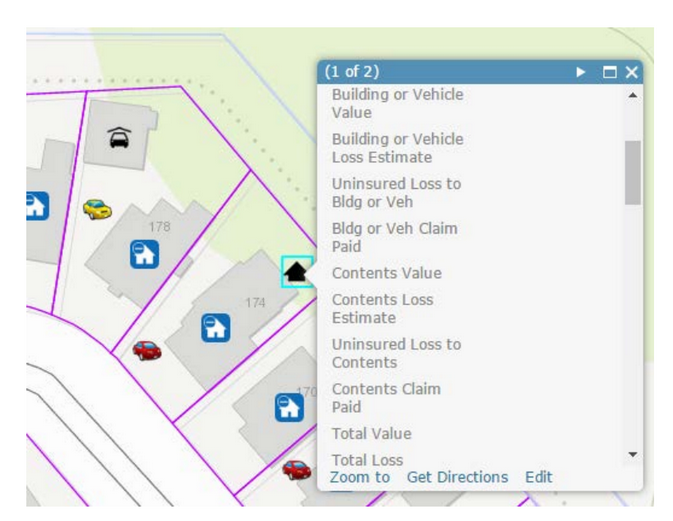

The tool chosen to collect data is a mapping product from ESRI Inc. that allows data collection via a series of points on a map (http://www.esri.com/products/collector-for-arcgis). Fire Safety Codes Officers (SCO) from across the province deployed to the RMWB and collected 7,716 data points, along with pictures that represent homes, outbuildings, vehicles and other losses.

Workflow

Since the information gathered by SCO’s begins to create a loss report, insurance companies and adjusters will not be required to submit a 1242 Insurance Report for every loss. Instead, adjusters will be asked to update the information within the map tool by first locating their client’s address and then editing the appropriate point representing that particular loss to include only the loss value and claim paid out. Adjusters can see the attached images for each point to help validate and qualify their loss estimates and payouts.

Please note that this tool is specifically for reporting on property damage directly incurred due to the RMWB wildfire and is not intended to replace previous or subsequent fire reporting in the province at this time.

Access

In order to gain access to the map, companies must provide a list of their intended users. The list must be in a csv (comma separated values) and contain the following: A header (first line) with these field names: Email, First Name, Last Name, Username.

This list can be sent to Kevin.McClement@gov.ab.ca and Micha.Jurisic@gov.ab.ca. Kevin McClement is the lead on managing this information. However, any questions or concerns can be sent to both recipients.

An automatic invite will be sent from ArcGIS Online to the identified email address. Once received, users can follow the link in the message to configure their profile, set a security question and create their password. Instructions on using the application are attached.

Clarification on the reporting requirements for the Fire Commissioner’s office – Fort McMurray Fires

The Fire Commissioner’s Office’s answers to the questions asked by an insurer about the reporting process may help you too, so we are sharing this withyou. Please note that if you have questions, please ask the Fire Commissioner’s office.

Questions asked by insurer:

Could you please clarify if this is loss reporting for any “payout” regarding the FM fires?

It states “Please note that this tool is specifically for reporting on property damage directly incurred due to the RMWB wildfire” so would this include any claim where we simply paid the Mass evacuation or we may have paid for a fridge to be replaced, or just food or, simply cleaning of the home/contents due to smoke?

Answer: insurance companies must report a fire loss to Office of the Fire Commissioner (OFC).

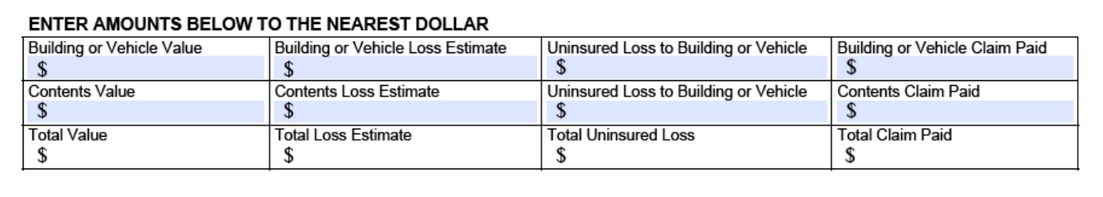

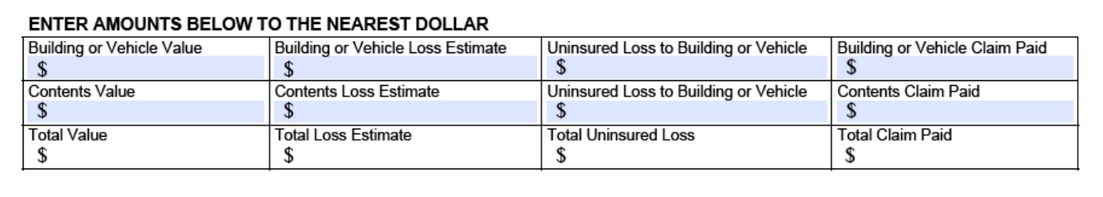

Normally, the way the reporting currently happens is that the fire department would submit a fire report to the OFC and then the owner’s insurance company would submit an insurance report containing the loss values. So, on a homeowner’s property there may be a home, vehicle, and detached garage. Let’s say the home was destroyed and you’ve paid out $250,000 for the building loss and $125,000 for the contents. That would go into the fields in the picture for the home report. In a new report, you would enter that the garage had minor damage resulting from the house fire, say $7,000 for new siding and $0 contents loss. The vehicle has cosmetic damage so you would pay to have the vehicle restored, costing $5,000.

If you have a claim where no direct fire damage was the cause, you would not report this to the OFC. Unsafe fridges, cleaning and other items not directly impacted by fire would not be a reportable loss to the OFC.

What investigators collected in the mapping tool are direct fire losses. We created a simplified form so that adjusters can go in afterward and enter the claim amount, payout and totals. Look up the claimant’s address and you can edit each investigation to complete the loss report.

Any questions or concerns can be sent to Kevin.McClement@gov.ab.ca and Micha.Jurisic@gov.ab.ca.

Jun 15, 2016 | News

MANITOBA ADJUSTER CONTINUING EDUCATION CREDIT REQUIREMENTS

For all other Canadian Insurance Continuing Education Requirements and Record Keeping please visit the ILScorp RESOURCE CENTER

QUESTION:

Do I have to complete continuing education credits to renew my licence?

ANSWER:

With the exception of Canadian non-residents who are licensed in a jurisdiction which has mandatory CE requirements, hail agents and adjusters, and restricted insurance agents (RIA), all other licensees are required to fulfill annual continuing education credit criteria.

QUESTION: How many continuing education credits do I need to renew my insurance license?

ANSWER:

Manitoba Adjusters

- 8 hours accumulated from July 1 – June 30

- maximum of 4 carry forward

Get CE Credits Online

QUESTION:

How do I find out how many credits I have carried forward from last year’s renewal?

ANSWER:

Important Note: Life and/or Accident & Sickness agents may not carry forward credit hours.

All other classes of licenses:

Your on-line Manitoba Insurance council CEC account will show how many carry forward credits you have if you entered all of your credits completed in the “2014-2015” CE Year. The responsibility to track credit hours rests with the licensee.

QUESTION:

As a Manitoba Adjuster, if I have completed a CE course in the past, but have taken it again this year, can I claim this towards my CE requirement?

ANSWER:

Entry of CE for the same course more than once may be permitted on an exception basis only. If an agent wishes to claim credit for a course more than once, the agent must contact Council for prior approval and

provide written reasons. This review is subject to the individual course review fee of $50.

QUESTION:

Do Non-Resident Agents/Brokers or Adjusters need to complete and report continuing education credits on-line?

ANSWER: Non-residents residing in Canadian jurisdictions that have mandatory CE requirements will be deemed to have met the requirement in Manitoba.

Non-residents residing in Canadian jurisdictions where CE is not mandatory are required to comply with Manitoba’s CE requirements. CE Credits must be obtained from an Accredited Course Provider or a course that has been individually approved by the ICM.

Residents of the United States of America are required to comply with the Manitoba CE requirements. CE Credits must be obtained from an Accredited Course Provider or a course that has been individually approved by the ICM.

However, if a Canadian non-resident or U.S. resident has completed a course that meets the applicable Manitoba requirements, the agent may apply for consideration of individual approval. The Individual CE Approval Application, along with the required fee, must be submitted to the ICM at least 30 days in advance of the course to ensure sufficient time to make an informed determination as to whether the CE course qualifies for Manitoba CE credits. More information can be found on the ICM website under “Continuing Education Info”.

Should the ICM determine that the CE course is not applicable to the Manitoba CE definition, the licensee would be required to complete additional CE courses to meet the mandatory Manitoba CE requirement

Jun 14, 2016 | News

The Ontario Government announces amendments to the Accessibility Standards for Customer Service.

Commencing July 1, 2016, there will be some significant changes to the Customer Service Standard under the AODA.

Customer Service Training

With the changes announced to the Customer Service Standard, many organizations will have additional people that require training.

ILScorp offers an online AODA training course that includes the mandated information and provides proof of training. This is a quick and easy way to train those staff, volunteers, and Board Members who will be required receive it. This course also qualifies for 1 RIBO Management CE hour.

Register for AODA training

The July 1, 2016 Changes. The first concerns the definition of a large organization. Up to now, under the Customer Service Standard, an organization was considered large if it had 20+ employees. This was in contrast to the Integrated Accessibility Standards Regulation (IASR) which defined a large organization as being one with 50+ employees. As of July 1st onwards, organizations with 50+ employees will be considered large under the Customer Service Standard, as well as the IASR.

Another important change as of July 1st is that all staff and volunteers, regardless of their contact with the public, must receive training on the Customer Service Standard. Previously only those who dealt directly with the public had to be trained. This means that all staff, volunteers, and Board Members must receive training on all five AODA standards but only organizations with 50+ employees have to keep a record of that training. Nonprofits and businesses who have not trained everyone in their organization on the Customer Service Standard will be required to do so.

The final amendment concerns service animals. The government has expanded the list of professionals authorized to provide documents indicating the need for a service animal. Doctors and nurses were originally the only ones allowed to provide such authorization, but the list now includes psychologists, psychotherapists, audiologists, chiropractors and optometrists.

Jun 7, 2016 | News

CIPR is short for Canadian Insurance Participant Registry.

The Canadian Insurance Participant Registry (CIPR) provides a single, secure, self-serve service where regulated parties can maintain, and control access to, their personal information. All registrants receive a unique identifier called their CIPR # which can be used to identify them to all signatories to the Registry including insurance regulators in all jurisdictions across the country, and eventually, participating insurers, LLQP providers, continuing education providers, etc.

Additionally, signatories have the option of delegating participant authentication to the Registry so registrants can use a single id and password to gain access to regulator sites across the country.

How do I get a CIPR Number?

To register with CIPR, please click this link and complete the registration and verification process.

If I forgot my CIPR number, can I simply get a new one?

No. If you create a new CIPR ID it is not linked to your license and you will not be able to renew your license. At least 2 weeks are required to repair this situation.

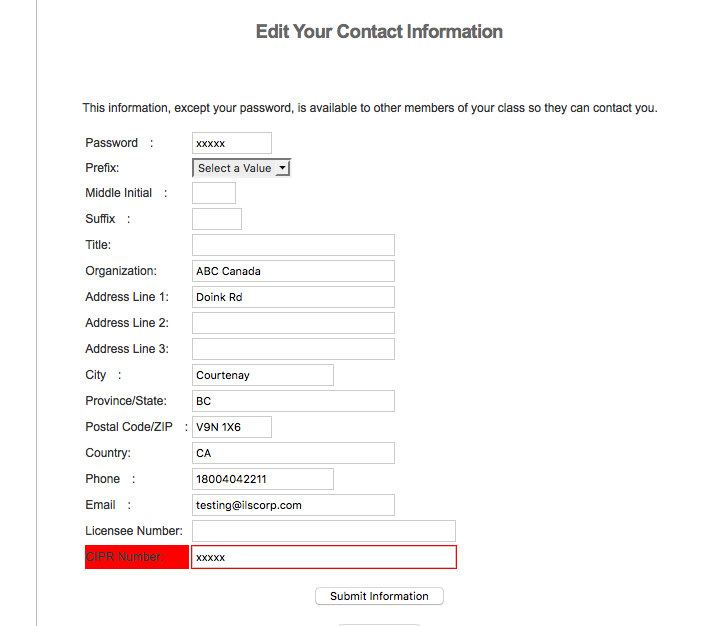

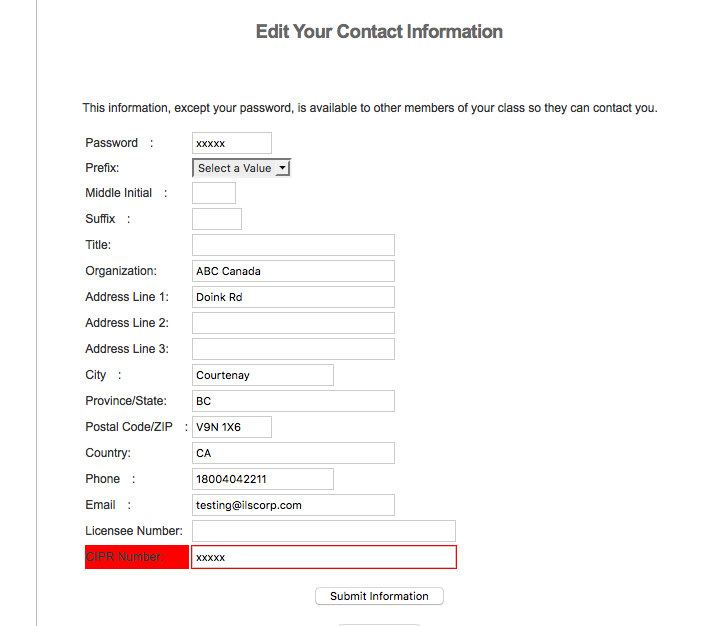

How do I add my CIPR number to my ILS profile?

As an ILS member in the ILS e-learning center, you can add your CIPR number to your profile so it will appear on your CE certificates.

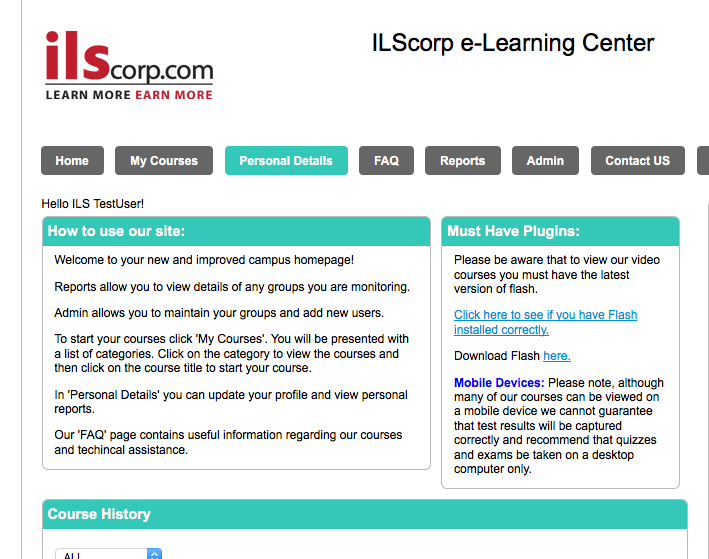

Sign in to ILScorp using your ILS UserID and Password.

— Click on “Personal Details” tab

— Then click on “Edit Contact Information” tab

— Update the “CIPR Number” located at the bottom of the contact information form.

Jun 2, 2016 | News

June 30, is the continuing education deadline for all insurance professionals in Alberta. Here are some answers to the most common questions asked by Agents, Brokers and Adjusters on Continuing Education Requirements in Alberta.

Q: What are the Certificate Terms for Continuing Education?

A: Life and Accident & Sickness insurance agents, General insurance agents and Adjusters are required to complete in each certificate term at least 15 hours of approved continuing education courses. Effective July 1, 2014, a “certificate term” means the period beginning on July 1 and ending on the next June 30.

Q: How do I know that I have satisfied my CE requirement?

A: You must log in to AIC and check your CE Summary Report. You are required to have completed 15 CE hours of approved courses each year in order to process the renewal of your license. All approved courses are found in the CE Course Lookup Section on the council web site. Contact ILScorp directly for assistance if you are unable to find a course.

Q: Are there any exemptions to the continuing education requirement?

A: Yes. Individuals who hold a General insurance agent’s certificate limited to hail insurance or livestock insurance and individuals who hold an Adjuster’s certificate limited to hail insurance, travel insurance or equipment warranty insurance are not required to complete a continuing education requirement.

Q: Are there exemptions for Maternity Leave/Long Term Disability?

A: There are no provisions under the Insurance Act or Regulations to allow an exemption for those agents who are on long term disability or maternity leave.

Q: Is there carry over of hours?

A: The Insurance Agents and Adjusters Regulation allows for a carry forward up to 7.5 hours of continuing education credits from one year to be used in the next year per class of license.

Q: What are the required hours for new agents?

A: 1.25 hours per licensed month. Agents who apply for a certificate of authority (license) with 3 or less months remaining in the certificate term are not required to complete the Continuing Education requirement. If your first license was issued on April 1st, you will not be required to complete a CE requirement until you renew your certificate in the following year.

Q: How do I determine if a course is accredited?

A: All courses which have been approved by the Accreditation Committee are listed on the Alberta Insurance Council website CE Course Lookup.

Q: Why can’t I enter the date that I completed my CE course(s)?

A: As you enter the course id number, a number of courses will be presented to you in a drop down for your selection. You must select the name of the course from the drop-down. A calendar will then be made available to select the date of completion. Some courses may have only been approved within a specific date range. If the date you wish to choose is not within the available date range, contact your course provider.

Q: When entering a CE course, I received a message that says “you are attempting to save a course in a closed CE term.” Can I still add the course?

A: You may still add courses in a CE term that has already been closed. Since you will not be able to modify or delete the course once it has been saved, you will be asked if you wish to continue to save the course. Click the “Continue” or “Cancel” button to proceed.

Q: When do I need these credits by?

A: When you renew your certificate of authority you are required to demonstrate that you have completed 15 hours of approved continuing education courses for each certificate being renewed by entering all approved courses under your profile.

Agents/adjusters who have not entered sufficient continuing education credits will not be able to renew their certificate(s) until sufficient courses have been entered.

Q: What happens if I do not complete sufficient CE courses? Can I renew my license and earn my CE credits later?

A: All insurance agents and adjusters who are required to complete a CE requirement will not be able to renew their certificate(s) until they have demonstrated that they have sufficient CE credit hours. Failure to complete the CE by June 30th will result in your certificate of authority automatically expiring and you will not be authorized to act as an insurance agent or adjuster until you have satisfied your CE requirement and re-applied for your certificate(s).

Q: Should we send in the certificates provided to us by the course providers?

A: No, these certificates are only required if the agent/adjuster becomes part of a random audit.

Q: Can a new agent use credits earned by a course taken before their license was issued?

A: New agents/adjusters may use credits earned by an approved course towards their first reporting period providing the course was taken in that certificate term.