RIBO Licensing Exam Preparation Course

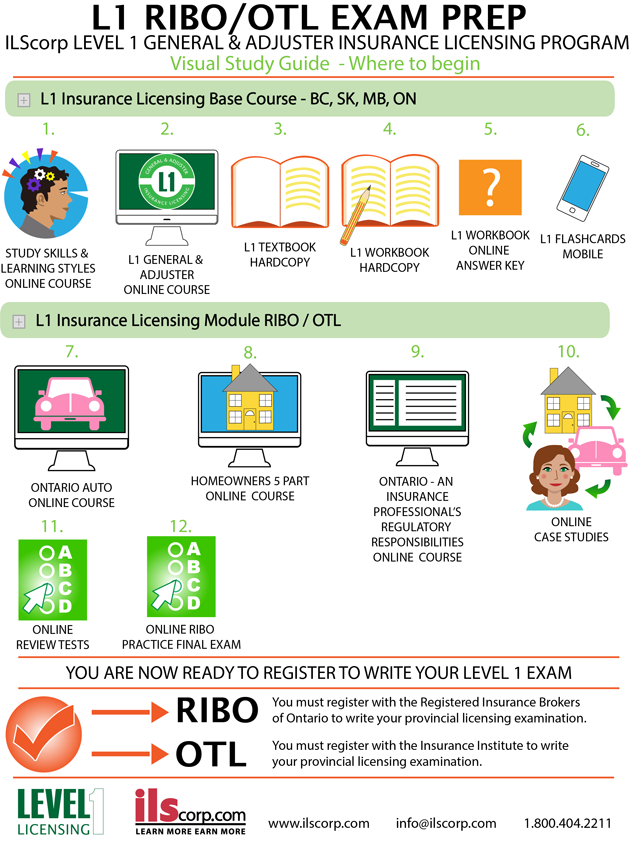

New ILS L1 Program has everything you need in one package to successfully pass your RIBO Level 1 General insurance licensing exam.

RIBO Level 1 General Insurance Licensing Exam Preparation Program includes:

-

- L1 General & Adjuster Insurance Licensing online course – 13 Chapters

- L1 Textbook hardcopy – 13 Chapters

- L1 Workbook hardcopy – over 650 quiz questions

- L1 Workbook Answer Key

- L1 Flashcards – over 300 mobile questions

- Ontario Auto online course

- An Insurance Professional’s Regulatory Responsibilities online course – ON council rules and code of conduct

- Homeowners Comprehensive Form online courses Parts 1-5

- Case Studies

- Review Tests – over 20 review tests including multiple choice answer options

- L1 General Insurance Licensing Practice Exam

- L1 RIBO Practice Exam

Access duration of 3 months – recommended study time of 80 – 120 hours

Total of 3 Continuing Education Credits (CE) – General/Adjuster – Technical

The RIBO Level 1 License allows you to sell Habitational (personal and commercial) Insurance Coverages, Auto Insurance Coverages, Travel Insurance, and Liability Coverages in Ontario.

The foundation of your ILS L1 Program is the online video course, hardcopy textbook, and workbook, each organized into easy to manage chapters. Utilizing all three learning elements enables you to listen to the content as it is narrated in the video course, follow along in your textbook, and enforce your knowledge retention by answering questions on key concepts in your workbook. With the ILS L1 Program all forms and coverages are current, key concepts are expressed using real life scenarios and examples, end of chapter quizzes can be taken as many times as you wish, and the workbook has over 650 exam type true or false questions along with answer keys.

Once you have mastered the foundation, the Ontario auto regulations, and further Ontario specific material is covered in additional online modules added to your ILS L1 Program. When all components of your ILS L1 Program are successfully completed, the material you’ve learned has prepped you for your RIBO Ontario General Insurance Level 1 Licensing Final Exam.

Note: You must register with the Registered Insurance Brokers of Ontario (RIBO) to write your provincial licensing examination.

Whats on the RIBO Entry Level Exam

The examination consists of one hundred (100) multiple choice questions. The pass mark is 75%. The time allowed to write the examination is three (3) hours.

Please note:

A policy wording booklet will be provided in the exam. Do not bring your own.

General (47 questions)

RIB Act and Regulations, Registration By-law

Principles and Practices in Insurance

Theory of Insurance

Insurance Contract

Meaning and Usage of Insurance Terms

Classes of Insurance

Purpose of Common Policies

Types of Insurers

Habitational Lines (24 questions)

Liability:

Comprehensive Personal Liability

Voluntary Medical Payments

Voluntary Compensation

Voluntary Property Damage

Contractual Liability

Owner’s Protective Liability

Residential Coverages: Fire and Extended Coverage

Seasonal and Secondary Residences

Homeowner’s Package

Tenant’s Package

Condominium Package

Personal Floaters

Vacancy Permit

Mortgage Clauses

Travel Insurance (5 questions)

Policy Conditions, Limitations and Claim Procedures

Automobile (24 questions)

OAP #1 – Owner’s Policy Form and Endorsements

Candidate should be familiar with coverage provided under OPF #2 – Driver’s Policy Form and OPF #6 – Non-Owned Automobile Policy Form

Whats the difference between RIBO and OTL?

OK, so what is the difference between an Insurance Agent and an Insurance Broker?

An Insurance Broker is a person that has permission to seek insurance quotations for an insured (client) or prospective client. A broker is not an insurance company employee. As a representative for the insured, brokers will approach several insurance companies in an attempt to provide quotations and coverage to adequately insure the client’s exposures. – Insurance Brokers Association Ontario

An Insurance Agent is a person who has entered into an ‘agency contract’ with an insurance company for the purpose of selling insurance for that one company. An agent is not an employee of the insurance company, but rather an independent contractor. The agent, unlike a broker, has the authority to bind coverage (legally obligate the insurance company to provide coverage according to the terms and conditions as bound). – Insurance Brokers Association Ontario

WHAT'S INCLUDED IN THE ILS L1 RIBO EXAM PREP PROGRAM

ILS courses and subscriptions are sold on an individual user basis and sharing of subscriptions for access to course materials is strictly forbidden. Any sharing of ILS intellectual property with any person or entity who does not have an assigned username and password will result in termination of course access without refund or compensation.