Sep 20, 2016 | News

View the video demo of the ILS Level 1 General Insurance Licensing Program and test your knowledge by taking the quiz.

The ILS Level 1 Licensing program has everything you need in one package to successfully pass your Level 1 General Insurance Licensing exam.

Still not sure if this program is the right choice for you?

View the CHAPTER 1 Video Demo and see what taking an online course is all about.

VIDEO DEMO ILS L1

The video demo is a sample of Chapter 1 of the L1 program – INTRODUCTION TO GENERAL INSURANCE

CHAPTER ONE CONTENT SAMPLE – Insurance is all about risk sharing. It’s not a new idea having been around for thousands of years. Risk sharing is a way of helping to ensure that a loss does not spell financial ruin for a person or business. It involves coming up with ways to accomplish that. Before the days of insurance companies, people came up with ways the community would share individual risks.

EXAMPLE 1: Back in the days of the caveman, when a hunter was killed in the hunt, his widow and family were supported by the other hunters.

EXAMPLE 2: The Yangtze River in China is a treacherous waterway and early traders travelling the river had their work cut out for them. Rather than take their entire trading goods over the many rapids on their own, they would meet at a sheltered area of the river and place a portion of their cargo in each of the many boats gathered there. This way, if one boat failed to negotiate the rapids safely, every boat owner still had some of their goods in the other boats. No one faced the prospect of losing everything and having to start their business over again. That’s what insurance does – it’s all about risk sharing.

Today, insurance companies take money from thousands of people and, for all practical purposes, keep that money in a pool from which to pay losses. The basic concept hasn’t changed – each contributor’s money is used to pay the losses of the few in their group who will have them. Basically, insurance is a mechanism for sharing the losses of the few among the many.

RISK AND RISK MANAGEMENT OPTIONS

Point 1: Definition of Risk: “Risk is the chance of financial loss as a result of loss or damage to the object of insurance or some other happening.” As individuals, we don’t know whether we will have a loss or not but we know that we will be worse off financially if we do. Everyone is exposed to risk in daily life, including:

Personal risk – the risk of dying, becoming seriously ill, disabled, or unemployed.

Property risk – the risk of loss or damage to property owned, rented or leased.

Liability risk – the risk of being held financially responsible for bodily injury or property damage caused to others.

People or organizations that have these kinds of risk face the potential for financial loss.

Point 2: There are two kinds of risk:

Speculative Risk: provides people with the chance to either make a profit or a loss.

Insurance is not intended for speculative risks. There is no insurance company willing to provide insurance for bankruptcy or loss of money from gambling.

EXAMPLE: Making the decision to go into business is a speculative risk. You either are successful or, as a worst-case scenario, you go bankrupt. Gambling is another example of a speculative risk. At the end of the day, you have either won money or lost money.

Pure Risk: provides only the potential for financial loss with no chance of gain or profit.

Insurance is provided for pure risks only. In other words, insurance can be purchased only for risks that have the potential for financial loss and no chance of financial gain. As we have seen, the purpose of insurance is to attempt to put the insured person back in the same position he or she was in immediately prior to the loss.

EXAMPLE : Owners of property will suffer financial loss when their property is lost or damaged. If there is no loss to their property, they do not gain or profit – their situation remains unchanged. Business owners can also be sued when their negligence causes bodily injury to another person or results in damage to that person’s property. If they are fortunate enough to carry on their business without being sued, they do not profit from that – their situation remains unchanged. There is no chance of profit or financial gain in these situations. Pure risk provides the chance only for financial loss.

CHAPTER 1

INTRODUCTION TO GENERAL INSURANCE

1. Insurance – The Basic Idea: Risk Sharing.

2. Risk and Risk Management Options

3. Definition of Insurance

4. Functions of Insurance

5. Types of Insurance Companies – Legal Form

6. Internal Organization of Insurance Companies

7. How Insurance is Distributed

This is just a quick sample of the ILS Level 1 General Insurance Licensing Program, to learn more about the program click here.

Sep 13, 2016 | News

If you’re thinking about starting a career in the insurance industry by completing your level 1 licensing courses online, you may be nervous and worried that the online learning environment will lack the “human touch” your used to in lectures and seminars.

However, online learning has come a long way over the last few years and it’s probably not what you imagine – instructors don’t just toss all the regular course materials online and leave it at that.

ILScorp has a a whole department dedicated to making online learning not only educational but also dynamic, engaging and interactive. We also have live customer service representatives available to you via email, live chat and telephone for any questions or assistance you may need along the way.

VIEW VIDEO DEMO OF LEVEL 1 LICENSING COURSE

Why should you consider taking classes online versus in a classroom?

The option to learn from anywhere, anytime – even while being in the comfort of pajamas – speaks for itself! The instructional planning and careful design of online courses takes into consideration the various learning styles and characteristics of online learners. Taking an online course creates an opportunity for those who value work-life balance, are self-directed and motivated, and are at varying stages in their professional development to improve their skills and meet their mandatory requirements faster.

The ILS Level 1 General Insurance Licensing Exam Preparation Program

The foundation of your ILS L1 Program is the online video course, hardcopy textbook, and workbook, each organized into easy to manage chapters. Utilizing all three learning elements enables you to listen to the content as it is narrated in the video course, follow along in your textbook, and enforce your knowledge retention by answering questions on key concepts in your workbook. With the ILS L1 Program all forms and coverages are current, key concepts are expressed using real life scenarios and examples, end of chapter quizzes can be taken as many times as you wish, and the workbook has over 650 exam type true or false questions along with answer keys.

The ILS L1 Program has everything you need in one package to successfully pass your Level 1 General Insurance Licensing exam. Start your career in insurance today.

MORE INFO ON L1 COURSE

Sep 6, 2016 | News

But why would you want to work in insurance?

Looking for a solid career that won’t require a multi-year college degree?

The insurance industry may be just the right place for you.

People may not think of insurance as the most glamorous industry in Canada, but it does offer stability, challenge and growth to those who choose the profession.

It’s an incredibly diverse and gratifying career choice, with huge scope for personal fulfillment, network building, professional development and of course financial reward. A career in insurance will take you as far as you want to go.

Insurance is already a huge part of everyday modern life, so why not find your career in it!

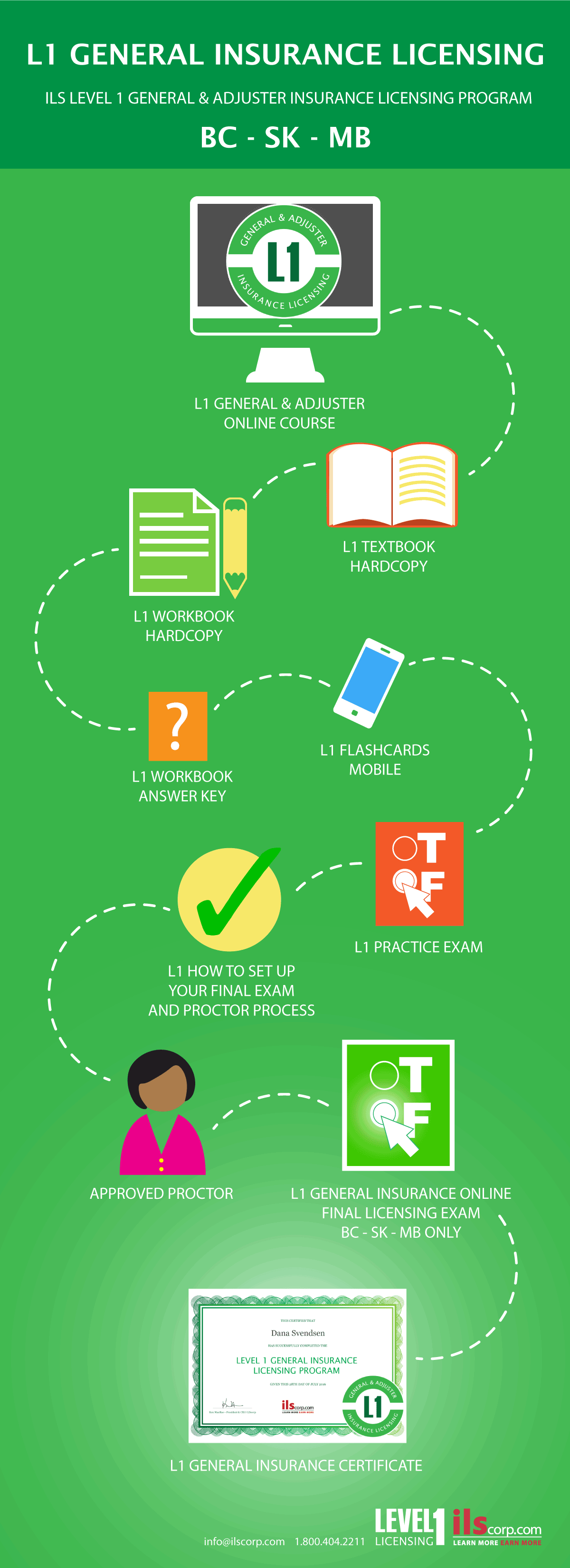

Become a Level 1 General Insurance Sales Agent without spending thousands of dollars or committing to years of schooling with ILScorp’s new Level 1 General Insurance Licensing Program.

With just 80 to 120 hours of self -study time, you can obtain your Level 1 License and begin your new career in the insurance industry.

Level 1 Licensing Program

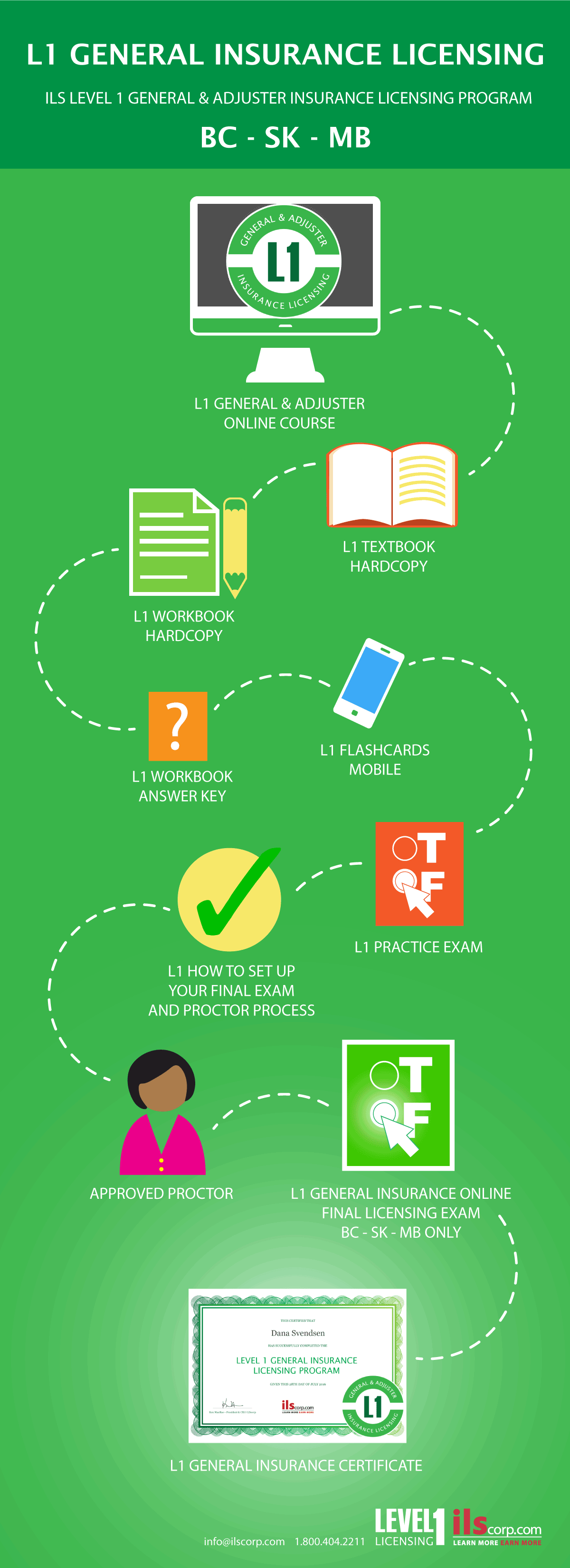

ILS L1 Program has all the learning material you need in one package.

The ILS L1 Program includes an online video course, hardcopy textbook, and workbook; each organized into easy to manage chapters. Utilizing all three learning elements enable you to listen to the content as it is narrated in the video course, follow along in the textbook, and enforce your knowledge retention by answering questions on key concepts in the workbook. At the start of each chapter in the online video course you will be introduced to the main topic and learning points and told the desired outcomes.

Cut through the jargon – Understand Insurance

Key concepts are expressed using real life scenarios and examples; you won’t need a translator or dictionary to learn the material.

Test yourself – again, and again and again….

End of chapter quizzes can be taken as many times as you wish and you can test yourself on the go with the L1 mobile flashcards with over 100 exam type questions. The L1 workbook has 650 questions along with answer keys plus the practice final exam will set you up to experience the actual online licensing exam scenario.

Your online Level 1 General Insurance Licensing Exam – yes it’s actually included!

As you may be in shock we’ll say it again. Your online Level 1 General Insurance Licensing Exam comes with your L1 Program. It’s included in the cost of the program and completed entirely online. Once you successfully pass the L1 Final Exam you’ve done it! Congratulations! You can now apply to your provincial insurance council to receive your Level 1 General Insurance License.

To learn more about the ILS Level 1 General Insurance Licensing Final Exam CLICK HERE

Level 1 Final Licensing Exam available for residents in BC, SK and MB.

Aug 30, 2016 | News

Your CE is fast, easy and done all at one low cost with the ILScorp General Insurance CE Course Subscription.

The ILS General CE Course Subscription contains over 185 provincially accredited courses including 21 courses that are RIBO accredited in the Management Category.

RIBO accredited courses in the Personal Skills and Technical Category are also part of the ILS General CE Course Subscription.

GET RIBO CE

With ILS General CE Course Subscription you will:

- have access to over 185 accredited general insurance training courses in both text and streaming video formats, including personal lines, commercial lines, auto, farm, professional management and personal skills courses

- save money compared to purchasing individual courses

- have a digital record of your CE and completed course work, which we keep on file for up to seven years

- save time by completing your general insurance continuing education requirements entirely online, no paperwork or commute

- print your CE certificates immediately or as needed

- have unlimited course access for 6 months

Advantages of your CE Course Subscription:

- Once you purchase your subscription, you can begin taking your courses immediately! If you are a new subscriber, you will receive an automated username and password by email.

- Courses can be accessed any time and you can log in and log out as many times as you wish during the course period

- Quizzes and Final exams are offered in our courses to help you retain the information

- All quizzes and Final exams can be taken as many times as you wish

- Should you require any assistance at any time during your course work, we are here to support you 5 days a week, 0800 – 1700 PST

View courses in this General Insurance CE Subscription

Aug 17, 2016 | News

Need RIBO Management CE for your September 30th deadline?

Introduction to Cyber Risks for Insurance Professionals is now available as part of your ILScorp CE Course Subscription.

Credit Hours: 3

Credit Type: General/Adjuster – Technical or Life/A&S

RIBO ACCREDITATION – 2 MANAGEMENT CE HOURS and 1 TECHNICAL

Introduction to Cyber Risks for Insurance Professionals provides information about the many ways in which cyber risks can influence the insurance industry and participants. Taking the approach that knowledge can reduce risks, the course deals with the most common threats presently experienced and focuses on efforts to counter the threats.

Topics include:

- The role of insurance in protecting against cyber risk.

- An overview of the various threats experienced by the largest industries in Canada.

- The technical terms associated with cyber risks; cybersecurity and cybercrime.

- Risk factors and risk management topics.

- Laws and legislation, and those presently under consideration, for dealing with cybercrimes.

Included as part of the ILScorp General Insurance CE Subscription

Included as part of the ILScorp Adjuster CE Subscription

Included as part of the ILScorp Life/A&S Insurance CE Subscription

Become an ILScorp group member to save even more

Aug 11, 2016 | News

New ILS L1 Program has everything you need in one package to successfully pass your OTL – Other Than Life – Level 1 General insurance licensing exam.

OTL Level 1 General Insurance Licensing Exam Preparation Program includes:

- L1 General & Adjuster Insurance Licensing online course – 13 Chapters

- L1 Textbook hardcopy – 13 Chapters

- L1 Workbook hardcopy – over 650 quiz questions

- L1 Workbook Answer Key

- L1 Flashcards – over 100 exam type mobile questions

- Ontario Auto online course – includes newest updates from June 2016

- An Insurance Professional’s Regulatory Responsibilities online course – ON council rules and code of conduct

- L1 General Insurance Licensing Practice Exam

- L1 OTL Multiple Choice Practice Exam

Access duration of 3 months – recommended study time of 80 – 120 hours

More Info

How to use your ILS OTL Level 1 General Insurance Licensing Exam Preparation Program

The foundation of your ILS L1 Program is the online video course, hardcopy textbook, and workbook, each organized into easy to manage chapters. Utilizing all three learning elements enables you to listen to the content as it is narrated in the video course, follow along in your textbook, and enforce your knowledge retention by answering questions on key concepts in your workbook. With the ILS L1 Program all forms and coverages are current, key concepts are expressed using real life scenarios and examples, end of chapter quizzes can be taken as many times as you wish, and the workbook has over 650 exam type true or false questions along with answer keys.

Once you have mastered the foundation, the Ontario auto regulations, and further Ontario specific material is covered in additional online modules added to your ILS L1 Program. When all components of your ILS L1 Program are successfully completed, the material you’ve learned has prepped you for your OTL General Insurance Level 1 Licensing Final Exam.

Note: You must register with the Insurance Institute to write your provincial licensing examination.

What’s the difference between OTL and RIBO?