Jan 24, 2017 | News

Press Release:

MISSISSAUGA, ON, Jan. 23, 2017

Starting in the spring of 2017, triOS College Business Technology Healthcare will be introducing a new Insurance diploma program and an Insurance Specialist diploma program.

This program is designed to address the huge need for individuals to replace a retiring workforce in the insurance industry, with a sole focus on property and casualty insurance. Graduates of this program will be able to pursue positions at insurance brokers, who play a key role in the communication between the carriers that provide insurance and the public who require it.

“Companies need people who have the specific skills that belong to their industry,” says Frank Gerencser, CEO of triOS Corporation. “The goal of this program is to give students all the insurance specific skills that they need, as well as the workplace expertise that will help them succeed.”

To create this program, triOS looked to industry leaders ILScorp, the largest online insurance training provider for the P&C industry in Canada. Under Ken MacRae, President and CEO of ILScorp, triOS Corporation has licensed their curriculum to embed it within their programs, ensuring that students obtain the highest standard training possible.

“There is a growing need in the insurance brokerage industry for new talent” says Ken MacRae, President and CEO of ILS Learning Corporation. “We are excited to partner with triOS to provide the training necessary for individuals to meet their provincial licensing requirements which enables them to access these exciting insurance career opportunities.”

This program includes a 2-month internship and preparation for the Registered Insurance Brokers of Ontario (RIBO) examination that will prepare graduates with the real-world experience they need for a career in the insurance industry.

Students interested in the new program are encouraged to contact triOS to schedule a free career training counselling session. International students who have previous education in insurance, and are looking to gain accreditation in Canada, are urged to contact the triOS Admissions Support Centre – International Department for more information on how to apply.

Dec 12, 2016 | News

ILScorp Offices Closed During Holiday Season 2016

This year we will be closed for the Christmas and Holiday season from December 26, 2016 until January 3, 2017.

During this period our live customer service representatives will be enjoying a well deserved holiday and our phone lines will automatically go to voicemail. Kindly leave us a message or better yet please send in tickets to info@ilscorp.com where your requests will be attended to as soon as possible upon our opening date on Tuesday January 3, 2017.

We invite you to place your orders well in advance in order to ensure we can assist you and you have a Happy Holiday Season too! During the ILScorp office closure all courses and subscriptions are available to purchase online via credit card.

Please note we will not be scheduling any licensing exams during the closure.

Just for good measure, here are some of our most commonly asked questions:

How do I retrieve my username and password for my insurance courses?

If you have forgotten your username or password simply:

- Go to www.ilscorp.com

- Click on ‘Forgot Password?’ under the log-in boxes

- Enter your email that we currently have on file for you

- If this method is unsuccessful, call our customer service reps at 1-800-404-2211 and we will assist you.

I’ve logged in and all I see is ‘No Courses Found’.

Why can’t I see my courses?

ILScorp courses are available for a specific amount of time from the date of purchase; your course(s) subscription may have expired. CE course subscriptions and individual courses are available for 6 months from the date of purchase, with unlimited amount of access. If you log into your ILScorp profile and do not see any courses listed under the “My Courses” tab, you can renew / purchase your course subscription from the ILScorp Course Catalog, or by choosing your subscription category here. Once your purchase is complete, you will have immediate access to your courses.

How do I register for more online insurance courses?

To renew your subscription or register for a licensing course simply:

- Go to www.ilscorp.com

- Do not log in – find the course you wish to take off the homepage and click ‘Buy Now’

- If you are a returning user – enter your current username/password – click ‘Sign In’ (Do not make a new account)

- If you are a new user – create a new account and fill in all applicable information – click ‘Submit Information’

- Enter your credit card information as it appears on your billing statement

Visit or FAQ page to see more. HAPPY HOLIDAYS!! See you in 2017.

ILScorp FAQs

Nov 14, 2016 | News

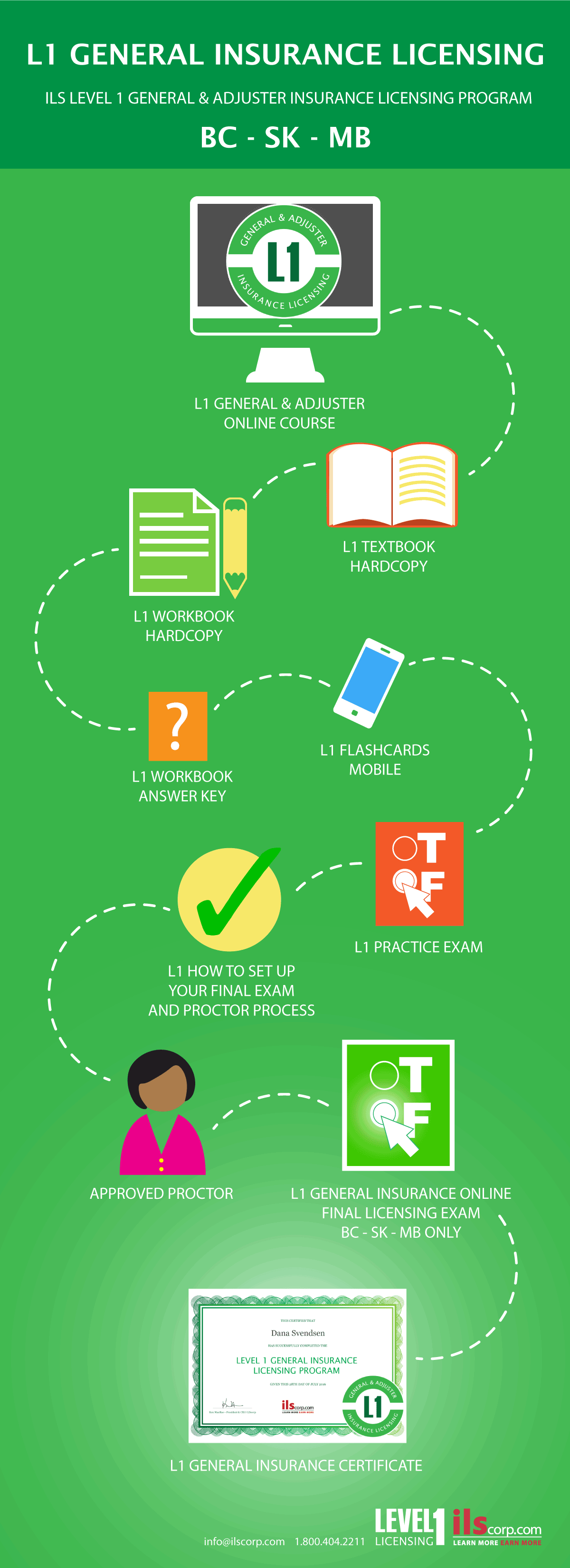

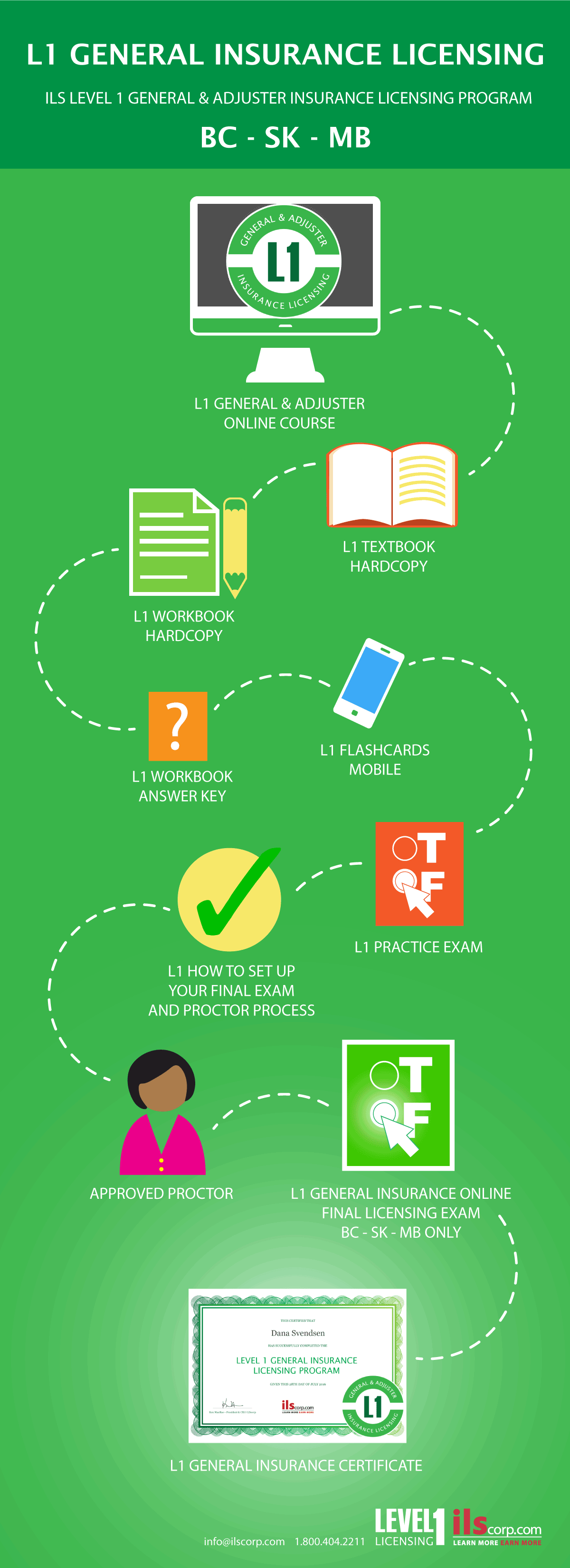

Your pathway to success begins with the ILS Level 1 General Insurance Licensing Program.

With just 80 -120 hours of self study time, you can obtain your Level 1 General Insurance License and begin your new career as a general insurance agent.

The ILS L1 Program has everything you need in one package to successfully pass your Level 1 General Insurance Licensing exam in BC, Saskatchewan and Manitoba

Level 1 General Insurance Licensing Exam Program includes:

- L1 General & Adjuster Insurance Licensing online course – 13 Chapters

- L1 Textbook hardcopy – 13 Chapters

- L1 Workbook hardcopy – over 650 quiz questions

- L1 Workbook Answer Key

- L1 Flashcards– over 100 exam type mobile questions

- L1 General Insurance Licensing Practice Exam

- L1 General Insurance Licensing Final Exam

Access duration of 3 months – recommended study time of 80 – 120 hours

The ILS Level 1 General Insurance Licensing Final Exam is composed of 200 True or False questions.

To pass, you must achieve a mark of at least 80%.

Prepare well and study hard

The foundation of your ILS L1 Program is the online video course, hardcopy textbook, and workbook, each organized into easy to manage chapters. Utilizing all three learning elements enables you to listen to the content as it is narrated in the video course, follow along in your textbook, and enforce your knowledge retention by answering questions on key concepts in your workbook. With the ILS L1 Program all forms and coverages are current, key concepts are expressed using real life scenarios and examples, end of chapter quizzes can be taken as many times as you wish, and the workbook has over 650 exam type true or false questions along with answer keys. Concentrate on one chapter at a time. Read through the chapter to get a general understanding of the material and then return to the material and review all key learning concepts. We recommend spending enough time to master the key concepts of each chapter before moving forward. Use your ILS Level 1 Flash Cards to help identify exam-like questions.

Nominate a Proctor for your Final Exam

Once you have completed the course and you are confident you have mastered the materials covered, call ILScorp at 1-800-404-2211 or go to the Level 1 Exam Process to begin your final exam procedures. All exam details including exam proctor information is available here: Level 1 Exam Process

Your Level 1 General Insurance Certificate

Once you have successfully passed your ILS Level 1 exam you will receive a certificate of completion from ILScorp. Print your certificate then apply to Council for your license. Your provincial Insurance Council requires the certificate as part of your Level 1 license application.

MORE INFO ON LEVEL 1

Nov 1, 2016 | News

An Independent Insurance Adjuster is an independent professional typically retained as a representative of the insurance company, but is not an employee of the insurance company.

An Independent Insurance Adjuster is responsible for:

- Investigating a claim

- Reviewing the terms of an insurance policy with the claimant

- Negotiating settlements

- Providing an explanation of the claims process and communicating progress of the claim to the claimant

- Requesting payments from the insurance company

In Manitoba, Independent Insurance Adjusters are licensed and regulated by the Insurance Council of Manitoba, and are required to:

- Meet licensing standards

- Maintain errors and omissions coverage, and

- Meet continuing education requirements

Independent Insurance Adjusters operate under the requirements of the Insurance Act of Manitoba and its Regulations, the Insurance Adjuster Licensing Rules and the Insurance Adjuster Code of Conduct.

COMMONLY ASKED QUESTIONS

The following are some commonly asked questions of Independent Adjusters with respect to their role in the claims process:

Why am I dealing with an adjuster and not the broker who arranged my policy?

The adjuster is a specialist in the claims process, and acts as the representative of the insurance company.

Will an adjuster help me get quotes on the work to be done?

The adjuster will provide you with guidance in obtaining quotes.

How many quotes are required?

This may vary depending on the requirements of the insurance company. Your adjuster will let you know how many quotes the insurance company will require.

Can I use my own supplier to do the work?

In many cases, this is an option. Your adjuster will be able to assist you with this information.

Will the adjuster help to ensure the repairs are done correctly?

After the value of the loss has been determined by the adjuster, it is up to you to ensure that work is done correctly and in accordance with all applicable codes and bylaws.

Will any payment be sent to me directly or to another party?

There are many variables that determine to whom the payment will be issued, including who has a financial interest in the property (i.e. mortgage, liens, ownership). The insurance company will make this determination, however the adjuster will assist you in communicating any request that you may have.

Will the adjuster visit the site to determine if the work is complete?

A site visit may be warranted but is not always required to complete the claim

If I do not agree with the adjuster’s determination of value or scope of work, what do I do?

You may wish to also consult your own experts for another opinion, and provide this information to the adjuster.

How long do I have to process my claim?

It is very important that you have clear and specific information concerning any and all time lines associated with your claim and your policy. The timelines for the processing of your claim are determined by the terms of your policy and requirements outlined in the Insurance Act of Manitoba. Your adjuster should outline these timelines for you.

Statement Taking and Investigations Online Course for Adjusters

SOURCE: Insurance Council of Manitoba – Working with your Adjuster – http://www.icm.mb.ca/working-adjuster

Oct 27, 2016 | News

Insurance fraud continues to be a major issue. It impacts every insurance company and virtually every customer as insurers increase premiums to offset fraud losses. The general consensus is that suspicious activity is increasing and the tactics used by fraudsters are more sophisticated.

So what constitutes insurance fraud? Insurance fraud happens when an individual or a group of persons deceives an insurance provider to get some money. They do this with full knowledge of the act and can be very resourceful when fabricating or exaggerating a claim.

Because insurance fraud can occur in so many different ways and may involve a wide range of participants, protecting yourself from it needs more than just common sense. You’d have to know the tell-tale signs of insurance scam so that you can proactively avoid falling for it.

Intro to Insurance Fraud Online Course

Trick No. 1: They follow global market trends.

Like any smart businessmen, insurance fraudsters are always alert to trends. Are the nouveau riche in China thirsting for luxury cars? No problem; organized fraud rings have built a veritable pipeline to the Asian black market.

Trick No. 2: They take advantage of the vulnerable.

Whether it’s disaster-stricken homeowners desperate to put their world right again or immigrants unclear on the ways of insurance, fraudsters prey on the vulnerable. Scammers also love to take advantage of people who’ve been hit with a natural disaster. Unlicensed and incompetent contractors descend on catastrophe-devastated areas and lure traumatized homeowners into signing contracts.

Trick No. 3: They make it happen on paper.

Emulating white-collar criminals, many staged-accident fraud rings bypass the dangers of “real” fake accidents altogether and instead make everything happen on paper, with fake passengers, fake injuries and fake treatment. Simply inventing medical treatment records of imaginary crashes increases the crook’s control and lessens the likelihood of being busted.

Statement Taking & Investigations Online Course

Emerging Insurance Fraud Trends

Fraudsters are highly adaptive and continually change tactics, strategies and even modes of operation.

In past years, most schemes seemed focused on false auto thefts and property arsons. Fraud schemes today have shifted much more to bodily injuries and suspicious activities by medical providers. Workers compensation and auto insurance most notably have seen these changes in tactics. In response, insurers increasingly are adopting advanced analytics to counter the changing nature of fraudulent activity.

One growing challenge is rising point-of-sale or underwriting fraud to illicitly reduce premiums.

Fraudsters can test system thresholds by filing many different applications online and manipulating rates by changing rating factors to reduce premium. In addition, analysis suggests that a significant amount of claims fraud is perpetrated through illegally obtained policies. By shifting from a reactive to a more-proactive posture, insurers are reducing fraud at policy inception, and are denying rate evaders a chance to file false claims once the ill-gotten policy is in force.

Cyber fraud is another emerging threat insurers are facing. Insurers collect a large amount of personal information that identity thieves aggressively seek. The number of companies reporting attacks has increased significantly since 2012. Yet, only 14 percent of insurers now employ technology to prevent cyber fraud, according to the current survey. That number is expected to significantly rise in the next few years

Cyber Risks For Insurance Professionals Online Course

SOURCE: http://www.insurancefraud.org

SOURCE: http://www.sas.com

Sep 27, 2016 | News

INSURANCE CONTRACT BASICS

People enter into insurance contracts for the protection these contracts provide. Contracts can be made orally or in writing. To eliminate disputes as to whether a contract existed, it is recommended that contracts having significant or long term obligations be made in writing.

Parties to the Contract: There are at least two parties to every contract regardless of its purpose. In property insurance contracts, these parties include:

– the insurer, and

– the insured.

EXAMPLE: Last week, Alex and Olivia Gregory completed an application for insurance for their home. The application was sent to the XYZ Insurance Company. They received their insurance policy yesterday. Both the Gregorys and the insurance company are considered to be parties to the contract.

The party that drafted the contract is generally considered to be the “first” party. In this case, that would be the XYZ Insurance Company. The other party, the Gregorys, is considered to be the “second” party.

There are people who are not considered to be a party to the contract but who are entitled to make a claim against it. These people are known as third party claimants. Liability insurance policies are an example of insurance contracts that provide for payment of claims directly to third parties.

Five Essential Elements Required of All Contracts

A contract is a legal agreement between two or more parties that is enforceable at law. There is not much sense having a contract if it is not enforceable at law. In order for a contract, regardless of its purpose, to be legal and, hence, binding on all parties, it must contain five essential elements, including:

(1) AGREEMENT

For agreement to exist there must have been a meeting of the minds between the parties as to:

– the subject matter of the contract, and

– its terms and conditions.

The term “meeting of the minds” is a legal term indicating that the parties know what the substance and terms of the contract are and that neither party has withheld information that should be known by the other party.

A definite offer must be communicated by one party to the other.

EXAMPLE: John Mandin saw a used ATV for sale in the newspaper. He called the owner saying that he liked it and that he might offer him the asking price when he came to see it later that day. The owner told him that he could come by any time. Later that day, the owner sold the ATV to another person. John was furious. He insisted that he had made an offer equal to the asking price and that the owner had led him to believe it was his for that price. In this case, a definite offer was not made. John indicated that he “might” buy the ATV for the asking price subject to the condition that he sees it first.

That offer must be unconditionally accepted by the other party.

EXAMPLE: i) A person looking to buy a home offers the seller $5,000 less than the listed price. The seller then advises the party making the offer that they will drop their asking price by $2,500.

ii) The applicant for insurance requested a policy with a $500 deductible. Today, the insurance company advised the applicant that the minimum deductible it was prepared accept for the property being insured was $1,000.

In these instances, there is no agreement. Instead, the seller of the home and the insurance company have made what is known as a counter-offer. A counter-offer makes the original offer invalid. If the person making the original offer decides not to accept the counter-offer, the process is over. However, if he or she still wants to establish a contract, the negotiating may begin all over again.

So long as this negotiation process is continuing, there is no agreement. Agreement exists only when one party unconditionally accepts the offer of the other party.

Once accepted, the offer cannot be withdrawn. However, once an insurance contract has been issued, it can be cancelled in accordance with the termination provisions included in it.

EXAMPLE: Last Monday morning, the insurance company underwriter informed the broker that the company would provide Mike’s Auto Body Inc. with a contract of insurance. However, that same afternoon the underwriter called the broker to tell her that he had thought about it some more and that he has made the decision to withdraw his acceptance of the offer made by the owner in his insurance application. According to contract law, the underwriter cannot do that. However, after the policy has been issued, the insurance company can exercise its right to cancel the policy by providing Mike’s Auto Body Inc. with proper notification as described in the that contract.

The offer and acceptance do not need to be in writing. In law, an oral agreement is as binding on the parties as is a written agreement.

The best way to avoid misunderstandings about the terms of the contract is to ensure that the offer and acceptance are provided in writing.

In the business of insurance, the application for insurance constitutes an offer. The issuing of the policy as applied for constitutes acceptance of that offer by the insurance company

When the application for insurance is in writing, the policy must be issued exactly as applied for. If the insurance company decides to make any changes, it must advise the applicant in writing of those changes.

The insured doesn’t have to accept the policy. if they don’t want to. In contract law, a person has up to two weeks (no time limit in Quebec) to reject the contract after receiving notification of the changes. If the insured does not do that, he or she is considered to have agreed to the changes.

If the insurance company does not provide the insured with written notification pointing out the difference between the insurance asked for on the application and the insurance that was actually provided on the policy, the insured may have a right to the coverage as applied for.

EXAMPLE: The insurance company issued the Olsen’s homeowner’s policy without the sewer back-up coverage requested by them on their application. The insurance company did not provide the Olsens with written notification of this reduction in coverage. Three weeks after having received the policy, the Olsens had a $30,000 sewer back-up loss. In this situation, the insurance company would in all likelihood be ordered to pay that claim. However, if the loss occurred six months after the Olsens had received the policy, the insurance company may well argue that they had sufficient time to notice the reduction in coverage and that they agreed to the change.

Normally, these kinds of oversights will not occur. This is because brokers and brokerage staff review all new policies to ensure they have been issued in accordance with the application. That is standard operating procedure in all brokerages.

(2) Legal Capacity to Contract

All individuals wishing to enter into a contract must be recognized at law as being entitled to do so. This generally includes all persons over 18 years of age. These persons are seen in law as having the legal capacity to contract with others.

Note: In Saskatchewan, a person who has attained the age of 16 years is considered to have the capacity of a person of 18 years to make an enforceable contract of insurance.

[Section 64, Insurance Act]

i) Minors are persons who are considered to be under the age of legal competence. That means they do not have the right to enter into a legal contract. In most provinces, minors include all persons less than 18 years of age.

This limitation helps to prevent the exploitation of people who often do not have the experience or sophistication required to properly protect themselves in business matters.

(ii) However, minors do have the restricted right to enter into contracts for the necessities of life such as food, clothing and lodging or other contracts made for their benefit.

This information is an excerpt from CHAPTER 2 of the ILS Level 1 General and Adjuster Insurance Licensing Program (L1). ILS L1 program is the most up to date provincial level 1 insurance licensing program available and contains everything you need in one package to successfully pass your level 1 insurance licensing provincial exam.

To start your career in insurance click here.