Read moreFour new courses in English and French, totaling 10 NEW Compliance/Conformite PDU credits, just added to the ILS CSF PDU Subscription.

ChAD PDUs earned for taking the same training maximum of two times

ChAD continuing education obligations

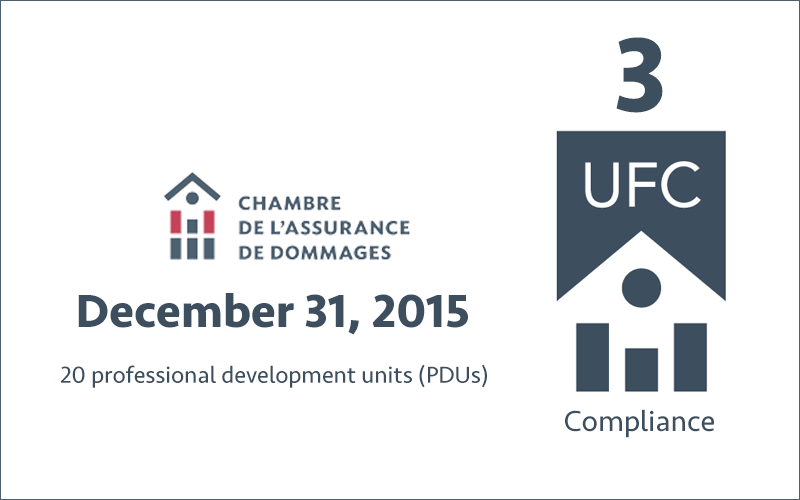

As a professional, one of your obligations is to complete 20 professional development units (PDUs) every two years. The new compliance period begins on Janurary 1, 2014 and ends on December 31, 2015.

Important Change: 2 PDUs for a training activity developed by the ChAD

Beginning with the 2016-2017 reference period, representatives will be obliged to take a course developed by the ChAD worth 2 professional development units (PDUs) dealing with either compliance with ethical or professional practice standards or with the evolution of the legal rules governing the sector of activity covered by the representative’s certificate. This new training will be offered at the ChAD’s online training site, ÉduChAD, and the PDUs earned will count towards the 20 mandatory PDUs representatives must earn during each reference period.

ILScorp Training Activities Accredited by ChAD

Limit on the number of PDUs earned for taking the same training

Since February 19, 2014, members may earn PDUs for taking the same training a maximum of two times, as long as the training is taken during two different reference periods. Consequently, a member who has already earned PDUs twice for the same training will not earn any further PDUs if he or she takes this training once again.

New Members’ Exemption from Earning PDUs

As a new member of the ChAD, you are exempted from having to earn PDUs for a period of 12 months after having successfully completed the Autorité des marchés financiers exams and received your certificate.

Carry-over of Five PDUs

Members who have earned extra PDUs are permitted to transfer up to five PDUs to end of the following compliance period.

Exemption from Earning PDUs Due to a Leave of Absence from the Profession

Should a representative wish to be exempted from his compulsory professional development obligations during a leave of absence from the profession for reasons of “force majeure” (sick leave, parental leave, etc.), he must inform the Chamber of this absence.

- Formulaire d’avis d’interruption (available in French only)

Classes and Subjects

The 20 PDUs that you are required to earn must come from the following five categories: Compliance, Administration, Insurance techniques, Law and legislation and Professional development

Compliance

These training activities must enable a member to become more knowledgeable and develop his/her expertise with respect to ethics and professional practice of damage insurance. This includes courses dealing with: The Act respecting the distribution of financial products and services, the Law and Rules of the Autorité des marchés financiers, keeping and preservation of books and registers, relevant legislation and regulations applied to damage insurance representatives and firms, ethics, inquiry process and the Privacy Act. A minimum of three (3) PDUs must be completed each compliance period.

Administration

These training activities must enable a member to become more knowledgeable and develop his/her expertise in the management and administration of a damage insurance firm. This includes courses on the following subjects: economics, accounting and finance, human resources management, marketing, information systems management, management and business strategies.

Insurance Techniques

These training activities must enable a member to become more knowledgeable and develop his/her expertise in the field of damage insurance. This includes courses dealing with: personal lines insurance, commercial lines insurance, risk management, claims adjustment, building services, investigation and loss-prevention techniques.

Law

These training activities must enable a member to become more knowledgeable and develop his/her expertise with respect to the relevant legislation and regulations. This includes courses dealing with: damage insurance, civil law and commercial law.

Professional Development

These training activities must enable a member to become more knowledgeable and develop his/her expertise in the field of damage insurance. This includes courses dealing with: customer service, sales techniques and knowledge transmission methods. A maximum of five (5) PDUs can be completed each compliance period

For more details, consult the

Did you know you can purchase your insurance CE courses online at anytime?

The ILScorp offices will be closed Wednesday November 11, Remembrance Day, to remember and honour those who have, and who continue to make sacrifices for our country.

Although the offices are closed you can purchase and renew your CE courses online at anytime through the ILScorp website.

How do I purchase and register for online insurance courses?

All of our online provincial insurance licensing courses, exam preparation courses and continuing education courses can be purchased through our website using your credit card.

To renew your CE Course Subscription or to register/purchase any of our online courses simply:

- Go to www.ilscorp.com

- If you are already an ILScorp Member do not log in – browse our website and once you find the course you want click ‘Buy Now’

- If you are already an ILScorp Member – enter your current username/password – click ‘Sign In’ – Do not make a new account

- If you are not an ILScorp Member – create an account by filling in all applicable information – click ‘Submit Information’

- To finish the purchase enter your credit card information as it appears on your billing statement.

- Once your purchase is complete, you will have immediate access to your courses.

You will automatically receive an email confirming your registration and this email will provide you with your username and password for course access. Now you can access your courses!

How do I access my online insurance courses once I have registered and purchased?

Once you have received your automatic email containing your username and password you can access your courses by:

- Visting www.ilscorp.com

- Log in with your username and password in the red Member Sign In Box.

- Welcome to your ILScorp e-learning campus

- Click on ‘My Courses’ on the top grey tab

- Choose a course category, and a click on the title of any course to begin.

I thought I already had access to online insurance courses. Why can’t I see my courses?

ILScorp courses are available for a specific amount of time from the date of purchase; your course(s) subscription may have expired. CE course subscriptions and individual courses are available for 6 months from the date of purchase, with unlimited amount of access. If you log into your ILScorp profile and do not see any courses listed under the “My Courses” tab, you can renew / purchase your course subscription from the ILScorp Course Catalog, or by choosing your subscription category here. Once your purchase is complete, you will have immediate access to your courses.

What is a professional development unit (PDU)?

A professional development unit or “PDU” is the quantitative value attributed to a training activity recognized by the Chambre de la Securite Financiere – CSF. One (1) PDU represents one (1) hour of training.

Can extra PDUs be carried over to the next period?

A representative can carry over up to 5 extra PDUs to the next reference period if the PDUs were accumulated in the last three months of a reference period, between September 1 and November 30 of an odd year. Carrying over extra PDUs must be done by the representative by logging in to their secure PDU record, through the Chambre de la Securite Financiere website in the Members’ Area.

How do I register for distance training?

You can purchase the training activities accredited by CSF offered by ILScorp here.

With the ILScorp CSF accredited training activities you will:

- have 6 months access to over 43 accredited CSF insurance training courses in both text and streaming video formats

- access over 100 PDUs in the categories compliance, insurance of persons, general subjects and group insurance of persons

- save money compared to purchasing individual courses

- have a digital record of your completed course work, which we keep on file for up to seven years

- save time by completing your PDU requirements entirely online, no paperwork or commute

- ILScorp does the reporting for you – ILScorp submits your completed PDU’s to the Chambre de la Securite Financiere on a monthly basis

What consequences will a member face if they do not respect their professional development requirements?

The representative must adhere to their professional development requirements by November 30 of the year in which the reference period ends. Unless being exempted from professional development by the CSF for medical, parental, or family reasons or obtaining during the previous year a licence to practice in a sector or registration category, the member who does not meet their requirements will have their certificate or registration suspended by the Autorité des marchés financiers, for each sector or registration category for which the continuous development requirements were not met.

For whom is professional development mandatory?

As per the Regulation of the Chambre de la sécurité financière respecting compulsory professional development, every member of the CSF, except financial planners who only operate within the financial planning sector, must meet the regulation’s requirements by obtaining at least 30 PDUs (Professional Development Units). If a member operates within more than one sector or registration category, they will be required to obtain 10 additional PDUs per extra sector or registration category. Financial planners must adhere to the regulations of the Institut québécois de la planification financière for their professional development.

National Stress Awareness Day

The 17th National Stress Awareness Day, which is held to celebrate helping people to beat stress is Wednesday 4 November 2015. The theme this year is “Employee well being as a worthwhile investment in your business”.

Do you know the main reasons for stress at work?

Situations that are likely to cause stress are those that are unpredictable or uncontrollable, uncertain, ambiguous or unfamiliar, or involving conflict, loss or performance expectations. Stress may be caused by time limited events, such as the pressures of examinations or work deadlines, or by ongoing situations, such as family demands, job insecurity, or long commuting journeys. Depression and issues from work are one of the main causes of stress.

Resources that help meet the pressures and demands faced at work include personal characteristics such as coping skills (for example, problem solving, assertiveness, time management) and the work situation such as a good working environment and social support. These resources can be increased by investment in work infrastructure, training, good management and employment practices, and the way that work is organized.

ILScorp offers the following training to help manage stress in the workplace.

Workplace Bullying Employee Version – Understanding Workplace Bullying & Tools for Safeguarding an Organization from Bullying Behaviour

The course is divided into four modules with a final exam:

- Identification of Workplace Bullying and the Law

- Preventing Workplace Bullying

- Developing a Workplace Bullying Prevention Program

- Conclusions

- Final Exam

Workplace Bullying Employer Version – Understanding Workplace Bullying & Tools for Safeguarding an Organization from Bullying Behaviour

The course is divided into five modules with a final exam:

- Identification of Workplace Bullying and the Law

- Developing a Workplace Bullying Prevention Program: Identify the Hazards / Risk Factors

- Preventing Workplace Bullying: Policy Development

- Developing a Workplace Bullying Prevention Program: Formal Resolution Process / Educational Programs

- Conclusions

- Final Exam

“Employers and employees alike need to be aware of the workplace bullying laws and regulations in place in Canada. It’s a pervasive issue that has significant long-term effects on individuals and businesses,” says Ken MacRae, President and CEO, ILScorp. “That’s why we offer these courses as a way to educate Canadians while helping them to ensure they are in compliance with the law.”

Both courses are now available through the ILScorp website at www.ilscorp.com for a cost of $85 per course (plus tax) and also included as part of your General or Adjuster CE Course Subscription.

Taking Control – Creating a Time Management System that Works for You

As insurance professionals, managing your time is important. From answering voicemails and emails to arranging meetings, there is a distinct need to have strong time management skills. This course examines the basic skills of organization and prioritizing. The information in this course drawn from the book entitled Time Management by Marc Mancini.

Outline:

- Organization and basic scheduling

- Time management misconceptions

- First priority: prioritizing

- Time killer: procrastination

- Goals, blocks, clusters and distractions

- Delegating

- Saying ‘No’

- Anticipation

- Time Crimes

- Tools of the Time Management Trade

This course is available through the ILScorp website at www.ilscorp.com for a cost of $85 (plus tax) and also included as part of your General or Adjuster CE Course Subscription.

New Harmonized LLQP for 2016.

As of January 1, 2016, a new life licensing qualification program will be in effect called the Harmonized LLQP (HLLQP).

This program will be implemented across Canada (including Quebec).

As a result of this regulatory change, all students currently registered in the existing ILScorp LLQP Program must register with their provincial insurance council and pass the provincial LLQP final licensing exam by December 31, 2015.

(Please note, you must complete the online LLQP course material, and pass the course Certification exam BEFORE you register and challenge the provincial licensing exam with your insurance council)

Students who do not successfully complete the provincial final licensing exam by December 31 2015, must enroll in the new 2016 Harmonized Life License Qualification Program in order to become life licensed.

Now is the time to obtain your life license with ILScorp’s streaming video LLQP Program. Register now and receive one free certification exam re-write.

More InfoThe ILS LLQP Online Video Course Consists of 18 Sections:

- Section 1: Financial Services Industry Overview

- Section 2: Life Insurance Products

- Section 3: Non-Forfeiture Options

- Section 4: Policy Dividends

- Section 5: Policy Riders

- Section 6: Features of Life Insurance

- Section 7: Common Law, Contract Law & Life Insurance

- Section 8: Beneficiary Designations

- Section 9: Group Insurance

- Section 10: Government Plans

- Section 11: Annuities

- Section 12: Registered Retirement Savings Plans

- Section 13: Segregated Funds Contracts (IVICs)

- Section 14: Taxation

- Section 15: Securities & Investments

- Section 16: Accident & Sickness

- Section 17: The Agent’s Role & Responsibilities

- Section 18: Needs Analysis/ Risk Management

With the ILScorp LLQP, you will receive: access to the LLQP Life Insurance Video Course, a series of exam-type case studies; an online mock exam and one attempt at the Certification Exam (register now to receive one free rewrite). With the ILScorp LLQP you can review any subjects before moving on in the course, or come back to topics at any time. Students should plan to spend between 80 and 120 hours preparing for the provincial LLQP exam.

Access: Expiring December 31st, 2015

No refunds on ILScorp course material not completed by December 31, 2015.