Jun 27, 2019 | Ethics CE, News

The Registered Insurance Brokers of Ontario recently updated the continuing education requirements for all RIBO Licensees.

As a RIBO licensee you need 1 Hour of RIBO Ethics CE by September 30, 2019, and then a new hour of Ethics CE every year between October 1st and September 30th.

ILScorp has your RIBO requirements for 2019 covered with the online course Making the Right Ethical Decisions, and we will be adding new RIBO Ethics CE courses each year.

This online 1 hour RIBO Ethics CE course can be purchased for $85.00 and is completed entirely online. Once you register you will receive a username and password to access the ILScorp e-learning centre. You will have 6 months of unlimited access to complete this course. Once you pass the final quiz you can print your CE certificate immediately. We will keep your CE certificate on file for up to 7 years in-case of audit.

Your Best Option to Access the Making the Right Ethical Decisions Course

Rather than purchase this course on its own, this course is also available as part of the ILScorp General CE Course Subscription.

The ILScorp General CE Course Subscription has over 186 online courses accredited in RIBO Management, RIBO Technical, RIBO Personal Skills and the RIBO Ethics CE Course.

This subscription is $185.00 and you receive 6 months of unlimited access to all 186 courses. Each time we release a new course you receive automatic access to the new courses at no extra charge.

So if you have an active ILScorp General CE Subscription when we release the new RIBO Ethics CE courses in October of 2019, you’ll automatically receive free access!

Contact ILScorp today.

Apr 2, 2019 | News

RIBO continuing education requirements vary by license and experience

Upon your RIBO license renewal, you must self-declare that you have obtained the required amount of continuing education credits. The Registered Insurance Brokers of Ontario (RIBO) recommends that you keep continuing education certificates for five years for random spot checks for compliance, but don’t worry, ILScorp keeps your completed course continuing education certificates for up to seven years!

Continuing education requirements vary by license and experience, as follows:

Principal brokers and deputy principal brokers:

10 hours of continuing education credits accumulated between October 1 and September 30 subject to the following conditions:

All other licensed individuals:

8 hours of continuing education credits accumulated between October 1 and September 30 subject to the following conditions:

- 1 hour minimum of RIBO Ethics CE

- 3 hours of RIBO Technical CE

- Maximum of 2 hours Personal Skills

- Carryover of 8 hours is permitted each year however the minimum category requirements must be maintained.

Newly-licensed individuals:

- The continuing education program of 8 hours every year between October 1st and September 30th will begin the first October following registration.

- Newly-licensed individuals are exempted for the remainder of the license year that they were registered

Mar 21, 2019 | News

Did you know that the insurance councils of Alberta will audit licensees who complete their CE at, or near, the end of the renewal deadline?

So, If you leave your continuing education completion to the last minute, you’re likely to be audited.

When do you need your CE credits by?

Life and Accident & Sickness insurance agents, General insurance agents and Adjusters in Alberta are required to complete in each certificate term at least 15 hours of approved continuing education courses. A “certificate term” means the period beginning on July 1 and ending on the next June 30.

To sum it up, if you’re completing your CE requirements in the last 2 weeks of June, expect a call from council.

I don’t want to risk being audited! Where can I get CE now?

ILScorp has hundreds of provincially accredited online continuing education courses, a majority of which are approved in Alberta. The courses are completed entirely online, with CE certificates available to you immediately upon successful completion. Register now, and have access to your courses instantly.

View CE Course Subscriptions

I’m being audited! How do I get my CE certificates?

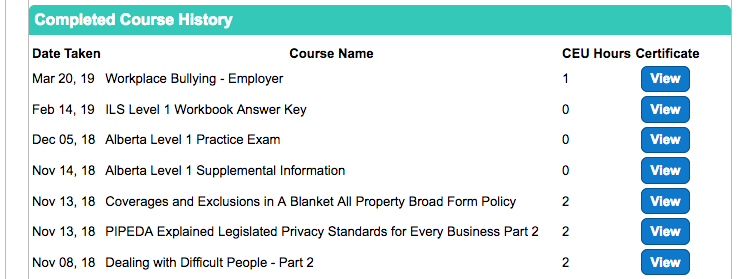

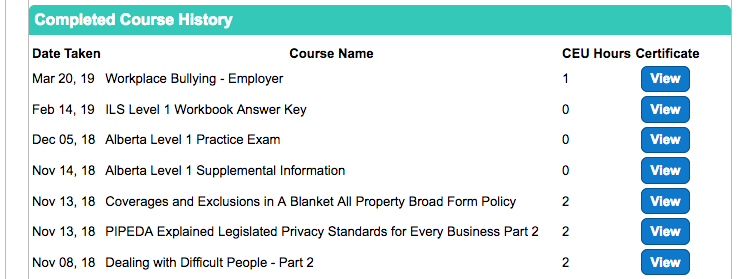

If you become part of an audit, you will be required to produce your CE Certificates of completion. ILScorp keeps your completed course history on file for up to 7 years in case of audit. Simply login to your ILScorp profile, and under your completed course history you’ll see all the course you’ve completed and the ability to view and print the CE certificate

How do I know that I have satisfied my CE requirement?

You must log in to the Alberta Insurance Council (AIC) and check your CE Summary Report. You are required to have completed 15 CE hours of approved courses each year in order to process the renewal of your license, and it is up to you enter your completed course ID numbers onto your council profile.

How do I determine if a course is accredited?

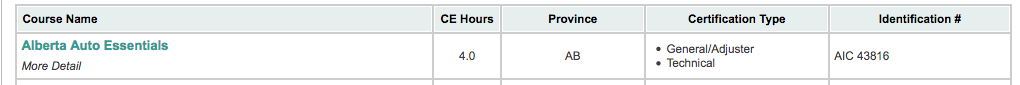

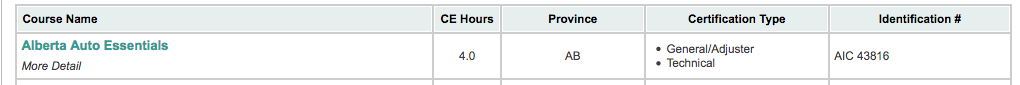

ILScorp courses are provincially accredited and all courses which have been approved by the Alberta Accreditation number will display an AIC number and the Alberta Flag.

Like this in the ILScorp Catalog:

Credit Hours: 2

Credit Type: General/Adjuster – Technical

Credit #: AIC#41982

Accrediting Provinces:

Or like this in your ILScorp e-Learning Campus

Are there any exemptions to the continuing education requirement?

Yes. Individuals who hold a General insurance agent’s certificate limited to hail insurance or livestock insurance and individuals who hold an Adjuster’s certificate limited to hail insurance, travel insurance or equipment warranty insurance are not required to complete a continuing education requirement.

Are there exemptions for Maternity Leave/Long Term Disability?

There are no provisions under the Insurance Act or Regulations to allow an exemption for those agents who are on long term disability or maternity leave.

Can I carry over hours?

The Insurance Agents and Adjusters Regulation allows for a carry forward up to 7.5 hours of continuing education credits from one year to be used in the next year per class of license.

What are the required hours for new agents?

1.25 hours per licensed month. Agents who apply for a certificate of authority (license) with 3 or less months remaining in the certificate term are not required to complete the Continuing Education requirement. If your first license was issued on April 1st, you will not be required to complete a CE requirement until you renew your certificate in the following year.

What happens if I do not complete sufficient CE courses? Can I renew my license and earn my CE credits later?

All insurance agents and adjusters who are required to complete a CE requirement will not be able to renew their certificate(s) until they have demonstrated that they have sufficient CE credit hours. Failure to complete the CE by June 30th will result in your certificate of authority automatically expiring and you will not be authorized to act as an insurance agent or adjuster until you have satisfied your CE requirement and re-applied for your certificate(s).

Get CE Courses

Mar 19, 2019 | News

Virtual Classrooms fast track your career advancement opportunities

If advancing your career is dictated by your higher education accomplishments, then you take the courses you need to upgrade your knowledge and skills. Earning your CAIB designation doesn’t have to mean years of study time, instead, the time you invest could only be months.

Virtual Classrooms are structured but you can customize your learning environment

Once you register for a Virtual Classroom, your study material is broken down into a 4 week calendar, with daily tasks to keep you on schedule. Although your program is structured, you can still enjoy a flexible schedule because even if it’s 2AM, you have access to all online course material such as videos, flashcards and workbooks. Review the course material as often as you need to help reinforce course concepts, your access is unlimited.

Virtual Classrooms give you immediate results

There is no waiting to learn your test scores, or if you passed the last quiz or not. All end of chapter quizzes and practice exams are completed online and your results are displayed immediately.

Virtual Classrooms allow you to communicate with your instructor

Through the Virtual Classroom discussion forum you have opportunities to get feedback or have a great Q&A session with your instructor and fellow classmates.

More Info

Mar 11, 2019 | News

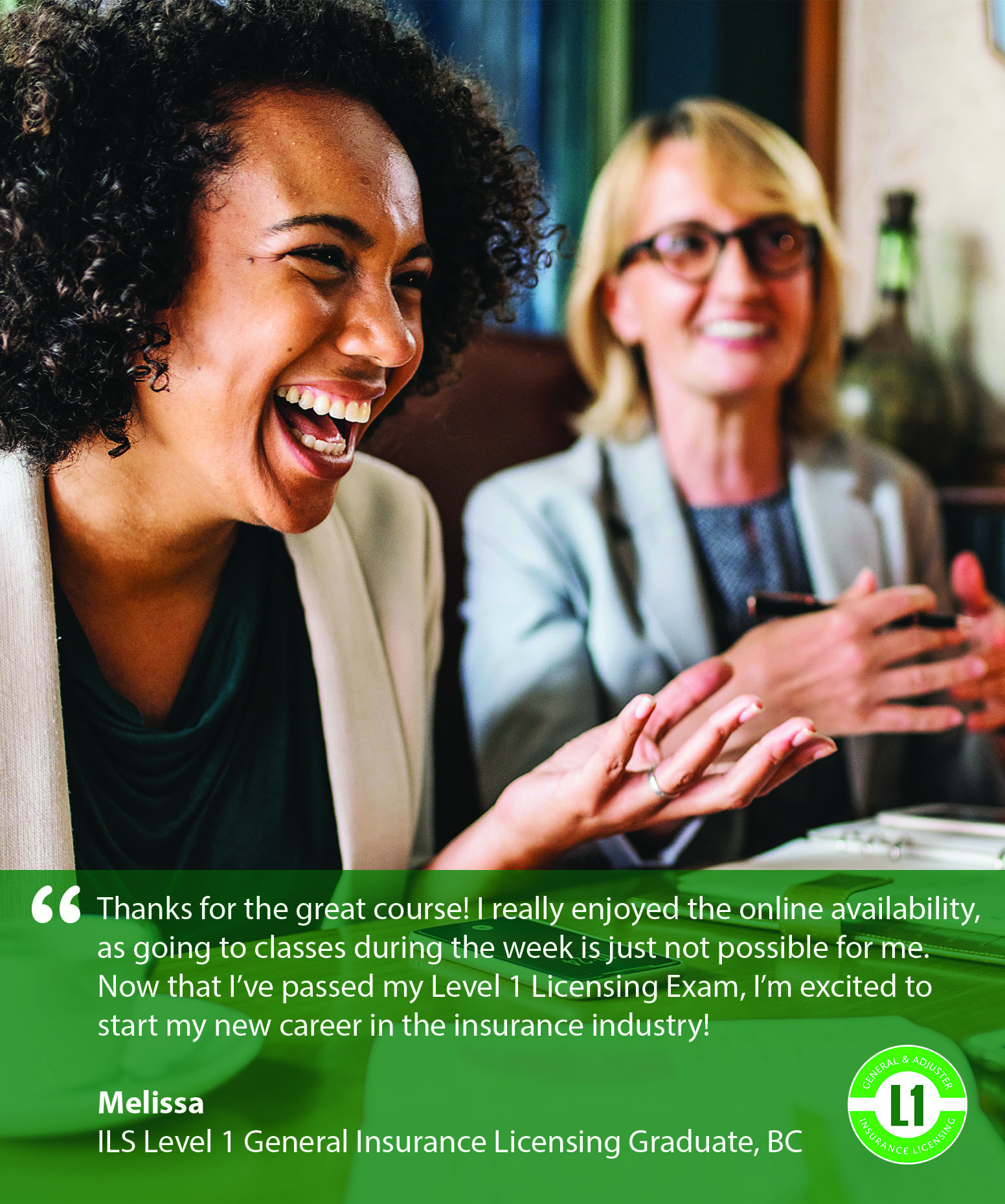

ILScorp offers Level 1 General Insurance or Adjuster Licensing Programs that are completed entirely online. Unlimited access to interactive video courses, flashcards, practice exams, even your final licensing exam is included. Everything you need in one package to successfully pass your level 1 insurance licensing exam.